The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 817 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th, 2020. What do these smart investors think about Mercadolibre Inc (NASDAQ:MELI)?

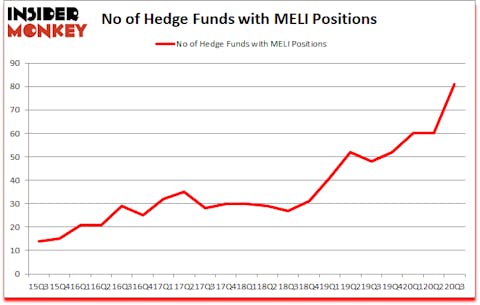

Is Mercadolibre Inc (NASDAQ:MELI) ready to rally soon? Hedge funds were in an optimistic mood. The number of long hedge fund positions went up by 21 lately. Mercadolibre Inc (NASDAQ:MELI) was in 81 hedge funds’ portfolios at the end of September. The all time high for this statistics is 60. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that MELI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 113% since March 2017 and outperformed the S&P 500 ETFs by more than 66 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Alex Sacerdote of Whale Rock Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a gander at the recent hedge fund action regarding Mercadolibre Inc (NASDAQ:MELI).

How have hedgies been trading Mercadolibre Inc (NASDAQ:MELI)?

At the end of September, a total of 81 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 35% from the previous quarter. By comparison, 48 hedge funds held shares or bullish call options in MELI a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, GQG Partners, managed by Rajiv Jain, holds the number one position in Mercadolibre Inc (NASDAQ:MELI). GQG Partners has a $1.2833 billion position in the stock, comprising 4.4% of its 13F portfolio. The second largest stake is held by Alkeon Capital Management, led by Panayotis Takis Sparaggis, holding a $553 million position; 1% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions include Andreas Halvorsen’s Viking Global, Alex Sacerdote’s Whale Rock Capital Management and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Prince Street Capital Management allocated the biggest weight to Mercadolibre Inc (NASDAQ:MELI), around 11.35% of its 13F portfolio. Marcho Partners is also relatively very bullish on the stock, earmarking 11.2 percent of its 13F equity portfolio to MELI.

Now, specific money managers have jumped into Mercadolibre Inc (NASDAQ:MELI) headfirst. Lone Pine Capital, established the most outsized position in Mercadolibre Inc (NASDAQ:MELI). Lone Pine Capital had $231.2 million invested in the company at the end of the quarter. Robert Boucai’s Newbrook Capital Advisors also made a $90.7 million investment in the stock during the quarter. The other funds with brand new MELI positions are Steve Cohen’s Point72 Asset Management, David Ma’s Composite Capital, and Lei Zhang’s Hillhouse Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Mercadolibre Inc (NASDAQ:MELI) but similarly valued. We will take a look at Global Payments Inc (NYSE:GPN), Northrop Grumman Corporation (NYSE:NOC), Chubb Limited (NYSE:CB), Dollar General Corp. (NYSE:DG), Micron Technology, Inc. (NASDAQ:MU), Truist Financial Corporation (NYSE:TFC), and Workday Inc (NYSE:WDAY). This group of stocks’ market values match MELI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPN | 57 | 4698299 | -9 |

| NOC | 42 | 843121 | -5 |

| CB | 45 | 1396414 | 5 |

| DG | 56 | 1824156 | -11 |

| MU | 79 | 4570742 | -5 |

| TFC | 29 | 180947 | -4 |

| WDAY | 74 | 4396870 | 1 |

| Average | 54.6 | 2558650 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 54.6 hedge funds with bullish positions and the average amount invested in these stocks was $2559 million. That figure was $5770 million in MELI’s case. Micron Technology, Inc. (NASDAQ:MU) is the most popular stock in this table. On the other hand Truist Financial Corporation (NYSE:TFC) is the least popular one with only 29 bullish hedge fund positions. Compared to these stocks Mercadolibre Inc (NASDAQ:MELI) is more popular among hedge funds. Our overall hedge fund sentiment score for MELI is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 30.7% in 2020 through November 27th but still managed to beat the market by 16.1 percentage points. Hedge funds were also right about betting on MELI as the stock returned 39.8% since the end of September (through 11/27) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Mercadolibre Inc (NASDAQ:MELI)

Follow Mercadolibre Inc (NASDAQ:MELI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.