Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by more than 6 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Marathon Petroleum Corp (NYSE:MPC) from the perspective of those elite funds.

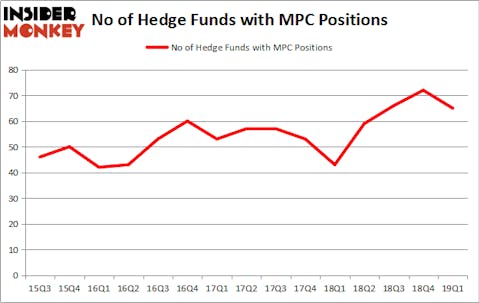

Is Marathon Petroleum Corp (NYSE:MPC) the right pick for your portfolio? Money managers are turning less bullish. The number of bullish hedge fund bets retreated by 7 lately. Our calculations also showed that MPC isn’t among the 30 most popular stocks among hedge funds. MPC was in 65 hedge funds’ portfolios at the end of March. There were 72 hedge funds in our database with MPC holdings at the end of the previous quarter.

In the eyes of most traders, hedge funds are assumed to be unimportant, outdated investment tools of years past. While there are over 8000 funds with their doors open today, Our researchers choose to focus on the top tier of this club, about 750 funds. These hedge fund managers control bulk of the smart money’s total capital, and by paying attention to their unrivaled picks, Insider Monkey has identified numerous investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to review the key hedge fund action surrounding Marathon Petroleum Corp (NYSE:MPC).

What have hedge funds been doing with Marathon Petroleum Corp (NYSE:MPC)?

Heading into the second quarter of 2019, a total of 65 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in MPC over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Andreas Halvorsen’s Viking Global has the largest position in Marathon Petroleum Corp (NYSE:MPC), worth close to $822.5 million, corresponding to 4.7% of its total 13F portfolio. The second largest stake is held by D E Shaw, managed by D. E. Shaw, which holds a $336.3 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism consist of Robert Pitts’s Steadfast Capital Management, Cliff Asness’s AQR Capital Management and Steve Cohen’s Point72 Asset Management.

Because Marathon Petroleum Corp (NYSE:MPC) has experienced falling interest from the smart money, logic holds that there lies a certain “tier” of funds that elected to cut their positions entirely last quarter. At the top of the heap, David Cohen and Harold Levy’s Iridian Asset Management dumped the biggest investment of the 700 funds watched by Insider Monkey, valued at close to $303.9 million in stock, and Alec Litowitz and Ross Laser’s Magnetar Capital was right behind this move, as the fund sold off about $49.6 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 7 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Marathon Petroleum Corp (NYSE:MPC). These stocks are ABB Ltd (NYSE:ABB), The Sherwin-Williams Company (NYSE:SHW), BCE Inc. (NYSE:BCE), and The Kraft Heinz Company (NASDAQ:KHC). This group of stocks’ market caps are closest to MPC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ABB | 15 | 347062 | 2 |

| SHW | 42 | 1153461 | -8 |

| BCE | 16 | 422698 | 0 |

| KHC | 29 | 11047679 | -4 |

| Average | 25.5 | 3242725 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $3243 million. That figure was $3263 million in MPC’s case. The Sherwin-Williams Company (NYSE:SHW) is the most popular stock in this table. On the other hand ABB Ltd (NYSE:ABB) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Marathon Petroleum Corp (NYSE:MPC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MPC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MPC were disappointed as the stock returned -20.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.