At Insider Monkey, we pore over the filings of nearly 873 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of June 30th. In this article, we will use that wealth of knowledge to determine whether or not Marathon Petroleum Corp (NYSE:MPC) makes for a good investment right now.

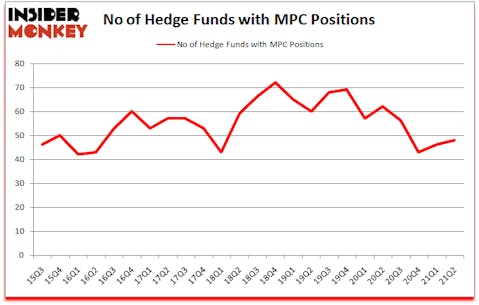

Is Marathon Petroleum Corp (NYSE:MPC) a good stock to buy? The best stock pickers were buying. The number of long hedge fund positions improved by 2 lately. Marathon Petroleum Corp (NYSE:MPC) was in 48 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 72. Our calculations also showed that MPC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most market participants, hedge funds are perceived as underperforming, old investment tools of years past. While there are greater than 8000 funds in operation at the moment, We look at the masters of this group, around 850 funds. These investment experts manage most of the smart money’s total asset base, and by paying attention to their inimitable picks, Insider Monkey has brought to light a few investment strategies that have historically outpaced the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website .

Paul Singer of Elliott Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a glance at the key hedge fund action surrounding Marathon Petroleum Corp (NYSE:MPC).

Do Hedge Funds Think MPC Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 48 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards MPC over the last 24 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in Marathon Petroleum Corp (NYSE:MPC) was held by Elliott Investment Management, which reported holding $638.6 million worth of stock at the end of June. It was followed by D E Shaw with a $541.3 million position. Other investors bullish on the company included Laurion Capital Management, Millennium Management, and Empyrean Capital Partners. In terms of the portfolio weights assigned to each position Elliott Investment Management allocated the biggest weight to Marathon Petroleum Corp (NYSE:MPC), around 4.92% of its 13F portfolio. Empyrean Capital Partners is also relatively very bullish on the stock, setting aside 3.8 percent of its 13F equity portfolio to MPC.

Now, some big names were leading the bulls’ herd. Elliott Investment Management, managed by Paul Singer, initiated the largest call position in Marathon Petroleum Corp (NYSE:MPC). Elliott Investment Management had $81.6 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $5.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Qing Li’s Sciencast Management.

Let’s go over hedge fund activity in other stocks similar to Marathon Petroleum Corp (NYSE:MPC). These stocks are The Allstate Corporation (NYSE:ALL), Fortinet Inc (NASDAQ:FTNT), Paychex, Inc. (NASDAQ:PAYX), Rocket Companies, Inc. (NYSE:RKT), Manulife Financial Corporation (NYSE:MFC), Cadence Design Systems Inc (NASDAQ:CDNS), and The Travelers Companies Inc (NYSE:TRV). All of these stocks’ market caps are similar to MPC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALL | 33 | 923765 | -8 |

| FTNT | 32 | 850545 | 9 |

| PAYX | 29 | 940182 | 4 |

| RKT | 13 | 115980 | -8 |

| MFC | 18 | 307415 | 1 |

| CDNS | 33 | 1623503 | 3 |

| TRV | 34 | 579032 | -1 |

| Average | 27.4 | 762917 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.4 hedge funds with bullish positions and the average amount invested in these stocks was $763 million. That figure was $2616 million in MPC’s case. The Travelers Companies Inc (NYSE:TRV) is the most popular stock in this table. On the other hand Rocket Companies, Inc. (NYSE:RKT) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Marathon Petroleum Corp (NYSE:MPC) is more popular among hedge funds. Our overall hedge fund sentiment score for MPC is 77. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 22.9% in 2021 through October 1st but still managed to beat the market by 5.6 percentage points. Hedge funds were also right about betting on MPC as the stock returned 6.3% since the end of June (through 10/1) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Marathon Petroleum Corp (NYSE:MPC)

Follow Marathon Petroleum Corp (NYSE:MPC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Best Solar Stocks for 2021

- 12 Largest Equipment Rental Companies

- Top 10 Cloud Computing Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.