Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s analyze whether Lexington Realty Trust (NYSE:LXP) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

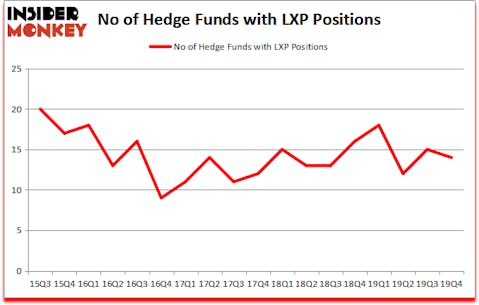

Lexington Realty Trust (NYSE:LXP) was in 14 hedge funds’ portfolios at the end of December. LXP has seen a decrease in activity from the world’s largest hedge funds recently. There were 15 hedge funds in our database with LXP holdings at the end of the previous quarter. Our calculations also showed that LXP isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

John Overdeck of Two Sigma Advisors

Now we’re going to view the recent hedge fund action surrounding Lexington Realty Trust (NYSE:LXP).

How are hedge funds trading Lexington Realty Trust (NYSE:LXP)?

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards LXP over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Lexington Realty Trust (NYSE:LXP) was held by Forward Management, which reported holding $16.5 million worth of stock at the end of September. It was followed by Two Sigma Advisors with a $14.9 million position. Other investors bullish on the company included Shoals Capital Management, Renaissance Technologies, and AQR Capital Management. In terms of the portfolio weights assigned to each position Shoals Capital Management allocated the biggest weight to Lexington Realty Trust (NYSE:LXP), around 7.9% of its 13F portfolio. Forward Management is also relatively very bullish on the stock, earmarking 2.52 percent of its 13F equity portfolio to LXP.

Judging by the fact that Lexington Realty Trust (NYSE:LXP) has experienced falling interest from the smart money, it’s easy to see that there was a specific group of hedge funds that decided to sell off their full holdings last quarter. Intriguingly, Clint Carlson’s Carlson Capital dumped the biggest investment of the “upper crust” of funds followed by Insider Monkey, valued at close to $32.5 million in stock, and Lawrence Raiman’s LDR Capital was right behind this move, as the fund cut about $2.5 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 1 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Lexington Realty Trust (NYSE:LXP). These stocks are Granite Real Estate Investment Trust (NYSE:GRP), Mercury General Corporation (NYSE:MCY), Euronav NV (NYSE:EURN), and Mimecast Limited (NASDAQ:MIME). This group of stocks’ market values match LXP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GRP | 7 | 47205 | -4 |

| MCY | 21 | 196767 | 0 |

| EURN | 28 | 232243 | 10 |

| MIME | 31 | 733997 | -8 |

| Average | 21.75 | 302553 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $303 million. That figure was $61 million in LXP’s case. Mimecast Limited (NASDAQ:MIME) is the most popular stock in this table. On the other hand Granite Real Estate Investment Trust (NYSE:GRP) is the least popular one with only 7 bullish hedge fund positions. Lexington Realty Trust (NYSE:LXP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but still beat the market by 5.5 percentage points. A small number of hedge funds were also right about betting on LXP as the stock returned -12.9% during the same time period and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.