At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

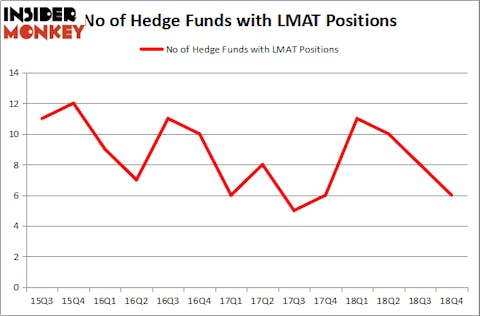

LeMaitre Vascular Inc (NASDAQ:LMAT) investors should be aware of a decrease in hedge fund interest of late. LMAT was in 6 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 8 hedge funds in our database with LMAT positions at the end of the previous quarter. Our calculations also showed that LMAT isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are dozens of gauges stock market investors put to use to evaluate stocks. A duo of the best gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top hedge fund managers can beat their index-focused peers by a very impressive margin (see the details here).

We’re going to go over the fresh hedge fund action regarding LeMaitre Vascular Inc (NASDAQ:LMAT).

How are hedge funds trading LeMaitre Vascular Inc (NASDAQ:LMAT)?

Heading into the first quarter of 2019, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LMAT over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Ken Griffin’s Citadel Investment Group has the largest position in LeMaitre Vascular Inc (NASDAQ:LMAT), worth close to $3.8 million, amounting to less than 0.1%% of its total 13F portfolio. On Citadel Investment Group’s heels is Marshall Wace LLP, led by Paul Marshall and Ian Wace, holding a $2.8 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish consist of Chuck Royce’s Royce & Associates, Cliff Asness’s AQR Capital Management and David Harding’s Winton Capital Management.

Because LeMaitre Vascular Inc (NASDAQ:LMAT) has faced bearish sentiment from the aggregate hedge fund industry, logic holds that there exists a select few money managers who sold off their positions entirely in the third quarter. It’s worth mentioning that Israel Englander’s Millennium Management dumped the biggest investment of all the hedgies followed by Insider Monkey, worth about $2.8 million in stock. Noam Gottesman’s fund, GLG Partners, also cut its stock, about $1.4 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to LeMaitre Vascular Inc (NASDAQ:LMAT). These stocks are BP Prudhoe Bay Royalty Trust (NYSE:BPT), Arrow Financial Corporation (NASDAQ:AROW), Barings BDC, Inc. (NYSE:BBDC), and A10 Networks Inc (NYSE:ATEN). All of these stocks’ market caps resemble LMAT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BPT | 4 | 4888 | 0 |

| AROW | 3 | 11071 | -1 |

| BBDC | 10 | 11904 | 1 |

| ATEN | 17 | 84026 | 2 |

| Average | 8.5 | 27972 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $10 million in LMAT’s case. A10 Networks Inc (NYSE:ATEN) is the most popular stock in this table. On the other hand Arrow Financial Corporation (NASDAQ:AROW) is the least popular one with only 3 bullish hedge fund positions. LeMaitre Vascular Inc (NASDAQ:LMAT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately LMAT wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); LMAT investors were disappointed as the stock returned 16.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.