Vulcan Value Partners, an investment management firm, published its “Large Cap, Small Cap, Focus Composite, Focus Plus Composite, and All Cap Composite” third quarter 2021 investor letter – a copy of which can be downloaded here. Vulcan’s Large Cap Composite Fund delivered a 0.1% net return for the third quarter of 2021, 11.8% for the Small Cap, -0.9% for the Focus Composite Fund, -0.9% return was delivered by the Focus Plus Composite Fund, and 3.4% was gained by the All Cap Composite Fund for the same period. You can take a look at the fund’s top 5 holdings to have an idea about their best picks for 2021.

Vulcan Value Partners, in its Q3 2021 investor letter, mentioned Lam Research Corporation (NASDAQ: LRCX) and discussed its stance on the firm. Lam Research Corporation is a Fremont, California-based semiconductor company with a $93 billion market capitalization. LRCX delivered a 39.92% return since the beginning of the year, while its 12-month returns are up by 47.90%. The stock closed at $660.79 per share on November 25, 2021.

Here is what Vulcan Value Partners has to say about Lam Research Corporation in its Q3 2021 investor letter:

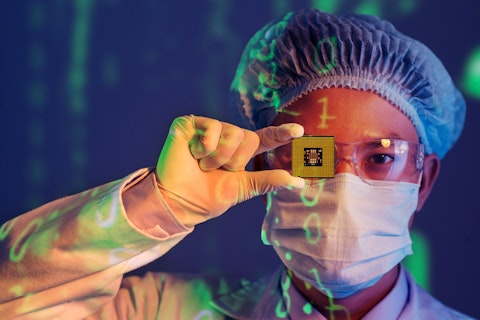

“Lam Research Corp. designs and manufactures equipment used in the fabrication of semiconductors. We would not invest in all companies in the semiconductor industry as many companies have more commoditized products. However, some of the semiconductor capital equipment companies are an exception. We purchased a competitor, Applied Materials, in the second quarter and purchased Lam Research this quarter. Consolidation within the industry has improved the company’s competitive position and key shifts in the industry are driving demand for more complex capital equipment. Among these shifts are an acceleration in the digital transformation of the global economy, the slowing of Moore’s law, and increased application of artificial intelligence (AI). The company generates robust free cash flow and has experienced strong and improving margins. We are delighted to have the opportunity to purchase Lam Research with a substantial margin of safety.”

Dragon Images/Shutterstock.com

Based on our calculations, Lam Research Corporation (NASDAQ: LRCX) was not able to clinch a spot in our list of the 30 Most Popular Stocks Among Hedge Funds. LRCX was in 47 hedge fund portfolios at the end of the third quarter of 2021, compared to 58 funds in the previous quarter. Lam Research Corporation (NASDAQ: LRCX) delivered a 12.89% return in the past 3 months.

Disclosure: None. This article is originally published at Insider Monkey.