In this article we will take a look at whether hedge funds think Lam Research Corporation (NASDAQ:LRCX) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

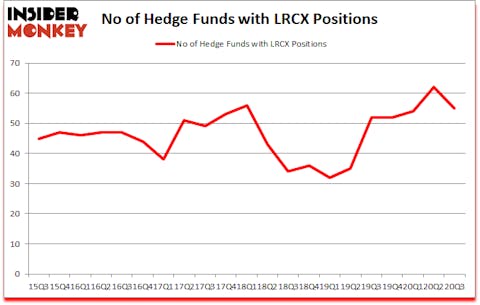

Is Lam Research (LRCX) a good stock to buy? Hedge funds were in a pessimistic mood. The number of bullish hedge fund bets were cut by 7 in recent months. Lam Research Corporation (NASDAQ:LRCX) was in 55 hedge funds’ portfolios at the end of September. The all time high for this statistics is 62. Our calculations also showed that LRCX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are perceived as underperforming, old financial tools of the past. While there are over 8000 funds trading at the moment, Our experts look at the elite of this group, approximately 850 funds. Most estimates calculate that this group of people administer the lion’s share of all hedge funds’ total capital, and by keeping track of their unrivaled investments, Insider Monkey has unsheathed many investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Lee Ainslie of Maverick Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to take a look at the new hedge fund action regarding Lam Research Corporation (NASDAQ:LRCX).

What have hedge funds been doing with Lam Research Corporation (NASDAQ:LRCX)?

At Q3’s end, a total of 55 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the second quarter of 2020. On the other hand, there were a total of 52 hedge funds with a bullish position in LRCX a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

More specifically, Coatue Management was the largest shareholder of Lam Research Corporation (NASDAQ:LRCX), with a stake worth $315.9 million reported as of the end of September. Trailing Coatue Management was Fisher Asset Management, which amassed a stake valued at $295.2 million. Alkeon Capital Management, Maverick Capital, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Marlowe Partners allocated the biggest weight to Lam Research Corporation (NASDAQ:LRCX), around 12.96% of its 13F portfolio. Heard Capital is also relatively very bullish on the stock, earmarking 9.02 percent of its 13F equity portfolio to LRCX.

Due to the fact that Lam Research Corporation (NASDAQ:LRCX) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely by the end of the third quarter. At the top of the heap, Alex Sacerdote’s Whale Rock Capital Management cut the biggest position of the 750 funds watched by Insider Monkey, totaling an estimated $178 million in stock. Brandon Haley’s fund, Holocene Advisors, also cut its stock, about $160.2 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 7 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lam Research Corporation (NASDAQ:LRCX) but similarly valued. We will take a look at Waste Management, Inc. (NYSE:WM), Aon plc (NYSE:AON), The Charles Schwab Corporation (NYSE:SCHW), PNC Financial Services Group Inc. (NYSE:PNC), Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR), Ferrari N.V. (NYSE:RACE), and Equinor ASA (NYSE:EQNR). This group of stocks’ market values match LRCX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WM | 38 | 2845066 | -1 |

| AON | 52 | 5410949 | -5 |

| SCHW | 53 | 3280246 | -18 |

| PNC | 37 | 740197 | -15 |

| PBR | 31 | 1006663 | 2 |

| RACE | 31 | 1322171 | 6 |

| EQNR | 20 | 324305 | 10 |

| Average | 37.4 | 2132800 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.4 hedge funds with bullish positions and the average amount invested in these stocks was $2133 million. That figure was $2248 million in LRCX’s case. The Charles Schwab Corporation (NYSE:SCHW) is the most popular stock in this table. On the other hand Equinor ASA (NYSE:EQNR) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Lam Research Corporation (NASDAQ:LRCX) is more popular among hedge funds. Our overall hedge fund sentiment score for LRCX is 74.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 31.6% in 2020 through December 2nd but still managed to beat the market by 16 percentage points. Hedge funds were also right about betting on LRCX as the stock returned 44.5% since the end of September (through 12/2) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Lam Research Corp (NASDAQ:LRCX)

Follow Lam Research Corp (NASDAQ:LRCX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.