Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 12.1% in the first 5 months of this year through May 30th (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Kinder Morgan Inc (NYSE:KMI).

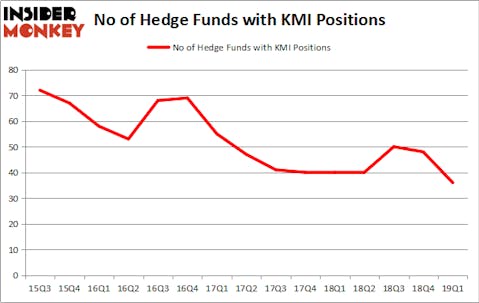

Kinder Morgan Inc (NYSE:KMI) investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. KMI was in 36 hedge funds’ portfolios at the end of the first quarter of 2019. There were 48 hedge funds in our database with KMI positions at the end of the previous quarter. Our calculations also showed that KMI isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the fresh hedge fund action regarding Kinder Morgan Inc (NYSE:KMI).

What does the smart money think about Kinder Morgan Inc (NYSE:KMI)?

At the end of the first quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -25% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in KMI over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, FPR Partners held the most valuable stake in Kinder Morgan Inc (NYSE:KMI), which was worth $546.9 million at the end of the first quarter. On the second spot was First Pacific Advisors LLC which amassed $344.1 million worth of shares. Moreover, Renaissance Technologies, Abrams Capital Management, and D E Shaw were also bullish on Kinder Morgan Inc (NYSE:KMI), allocating a large percentage of their portfolios to this stock.

Since Kinder Morgan Inc (NYSE:KMI) has faced a decline in interest from the smart money, it’s safe to say that there was a specific group of funds who sold off their entire stakes by the end of the third quarter. Intriguingly, Phill Gross and Robert Atchinson’s Adage Capital Management said goodbye to the largest position of the 700 funds followed by Insider Monkey, comprising about $36.2 million in stock, and Jonathan Barrett and Paul Segal’s Luminus Management was right behind this move, as the fund said goodbye to about $35 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 12 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Kinder Morgan Inc (NYSE:KMI). These stocks are Regeneron Pharmaceuticals Inc (NASDAQ:REGN), HCA Healthcare Inc (NYSE:HCA), Banco de Chile (NYSE:BCH), and Brookfield Asset Management Inc. (NYSE:BAM). This group of stocks’ market values are closest to KMI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REGN | 31 | 900292 | -4 |

| HCA | 51 | 2667753 | -5 |

| BCH | 4 | 73861 | 0 |

| BAM | 26 | 824917 | 1 |

| Average | 28 | 1116706 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1117 million. That figure was $1729 million in KMI’s case. HCA Healthcare Inc (NYSE:HCA) is the most popular stock in this table. On the other hand Banco de Chile (NYSE:BCH) is the least popular one with only 4 bullish hedge fund positions. Kinder Morgan Inc (NYSE:KMI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on KMI, though not to the same extent, as the stock returned 1.5% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.