At Insider Monkey, we pore over the filings of nearly 866 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31st. In this article, we will use that wealth of knowledge to determine whether or not iRobot Corporation (NASDAQ:IRBT) makes for a good investment right now.

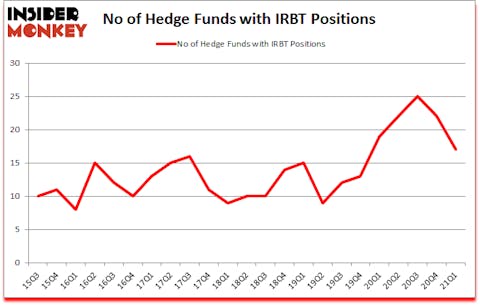

Is IRBT a good stock to buy? Money managers were reducing their bets on the stock. The number of long hedge fund bets decreased by 5 in recent months. iRobot Corporation (NASDAQ:IRBT) was in 17 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 25. Our calculations also showed that IRBT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). There were 22 hedge funds in our database with IRBT positions at the end of the fourth quarter.

Today there are a lot of signals stock market investors employ to analyze their stock investments. A pair of the most underrated signals are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outpace the market by a healthy margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a look at the key hedge fund action encompassing iRobot Corporation (NASDAQ:IRBT).

Do Hedge Funds Think IRBT Is A Good Stock To Buy Now?

At the end of March, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from the fourth quarter of 2020. By comparison, 19 hedge funds held shares or bullish call options in IRBT a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the number one position in iRobot Corporation (NASDAQ:IRBT), worth close to $61.9 million, accounting for 0.1% of its total 13F portfolio. The second most bullish fund manager is Citadel Investment Group, led by Ken Griffin, holding a $25.8 million call position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions contain D. E. Shaw’s D E Shaw, and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Algert Global allocated the biggest weight to iRobot Corporation (NASDAQ:IRBT), around 0.11% of its 13F portfolio. Arrowstreet Capital is also relatively very bullish on the stock, earmarking 0.08 percent of its 13F equity portfolio to IRBT.

Since iRobot Corporation (NASDAQ:IRBT) has faced declining sentiment from the entirety of the hedge funds we track, we can see that there exists a select few hedgies who sold off their full holdings by the end of the first quarter. Interestingly, Daniel S. Och’s OZ Management sold off the largest position of the “upper crust” of funds watched by Insider Monkey, worth close to $14.2 million in stock, and Steven Ng and Andrew Mitchell’s Ophir Asset Management was right behind this move, as the fund dropped about $12 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 5 funds by the end of the first quarter.

Let’s go over hedge fund activity in other stocks similar to iRobot Corporation (NASDAQ:IRBT). These stocks are Blackbaud, Inc. (NASDAQ:BLKB), InnovAge Holding Corp. (NASDAQ:INNV), Weingarten Realty Investors (NYSE:WRI), PDC Energy Inc (NASDAQ:PDCE), ABM Industries, Inc. (NYSE:ABM), Copa Holdings, S.A. (NYSE:CPA), and 3D Systems Corporation (NYSE:DDD). This group of stocks’ market caps are closest to IRBT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BLKB | 20 | 109333 | 1 |

| INNV | 32 | 190847 | 32 |

| WRI | 14 | 200031 | 1 |

| PDCE | 24 | 292637 | 3 |

| ABM | 17 | 40361 | -3 |

| CPA | 18 | 213264 | -3 |

| DDD | 16 | 315553 | 1 |

| Average | 20.1 | 194575 | 4.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.1 hedge funds with bullish positions and the average amount invested in these stocks was $195 million. That figure was $148 million in IRBT’s case. InnovAge Holding Corp. (NASDAQ:INNV) is the most popular stock in this table. On the other hand Weingarten Realty Investors (NYSE:WRI) is the least popular one with only 14 bullish hedge fund positions. iRobot Corporation (NASDAQ:IRBT) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for IRBT is 28.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd and surpassed the market again by 10.1 percentage points. Unfortunately IRBT wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); IRBT investors were disappointed as the stock returned -27% since the end of March (through 7/23) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Irobot Corp (NASDAQ:IRBT)

Follow Irobot Corp (NASDAQ:IRBT)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Electronics Companies in the World

- 10 Best Agriculture Stocks to Invest In

- 25 States With Highest Depression Rates

Disclosure: None. This article was originally published at Insider Monkey.