Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Innophos Holdings, Inc. (NASDAQ:IPHS)? The smart money sentiment can provide an answer to this question.

Hedge fund interest in Innophos Holdings, Inc. (NASDAQ:IPHS) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Fly Leasing Ltd (NYSE:FLY), B. Riley Financial, Inc. (NASDAQ:RILY), and Luther Burbank Corporation (NASDAQ:LBC) to gather more data points. Our calculations also showed that IPHS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are numerous methods stock market investors have at their disposal to appraise their stock investments. Some of the most under-the-radar methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top investment managers can outperform the market by a significant amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December we recommended Adams Energy based on an under-the-radar fund manager’s investor letter and the stock gained 20 percent. Let’s analyze the fresh hedge fund action surrounding Innophos Holdings, Inc. (NASDAQ:IPHS).

How are hedge funds trading Innophos Holdings, Inc. (NASDAQ:IPHS)?

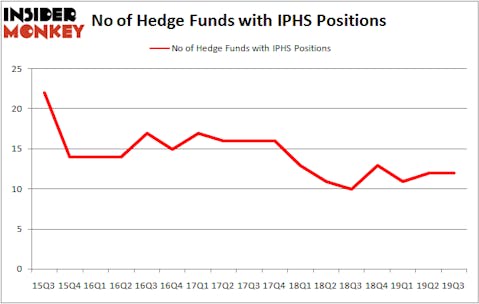

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in IPHS over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, holds the number one position in Innophos Holdings, Inc. (NASDAQ:IPHS). Renaissance Technologies has a $29.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $4.8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism encompass Israel Englander’s Millennium Management, John Overdeck and David Siegel’s Two Sigma Advisors and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Zebra Capital Management allocated the biggest weight to Innophos Holdings, Inc. (NASDAQ:IPHS), around 0.29% of its 13F portfolio. Fondren Management is also relatively very bullish on the stock, designating 0.27 percent of its 13F equity portfolio to IPHS.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Laurion Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was PEAK6 Capital Management).

Let’s now review hedge fund activity in other stocks similar to Innophos Holdings, Inc. (NASDAQ:IPHS). These stocks are Fly Leasing Ltd (NYSE:FLY), B. Riley Financial, Inc. (NASDAQ:RILY), Luther Burbank Corporation (NASDAQ:LBC), and Voyager Therapeutics, Inc. (NASDAQ:VYGR). All of these stocks’ market caps resemble IPHS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLY | 7 | 70263 | 0 |

| RILY | 14 | 118890 | 4 |

| LBC | 7 | 10312 | 0 |

| VYGR | 16 | 107789 | -2 |

| Average | 11 | 76814 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $77 million. That figure was $43 million in IPHS’s case. Voyager Therapeutics, Inc. (NASDAQ:VYGR) is the most popular stock in this table. On the other hand Fly Leasing Ltd (NYSE:FLY) is the least popular one with only 7 bullish hedge fund positions. Innophos Holdings, Inc. (NASDAQ:IPHS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately IPHS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IPHS were disappointed as the stock returned -1.7% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.