Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Icahn Enterprises LP (NASDAQ:IEP) based on that data.

Hedge fund interest in Icahn Enterprises LP (NASDAQ:IEP) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare IEP to other stocks including Huntington Bancshares Incorporated (NASDAQ:HBAN), WellCare Health Plans, Inc. (NYSE:WCG), and Martin Marietta Materials, Inc. (NYSE:MLM) to get a better sense of its popularity. Our calculations also showed that IEP isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a multitude of metrics stock market investors have at their disposal to evaluate their holdings. A couple of the most under-the-radar metrics are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outperform their index-focused peers by a very impressive amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the latest hedge fund action surrounding Icahn Enterprises LP (NASDAQ:IEP).

What does smart money think about Icahn Enterprises LP (NASDAQ:IEP)?

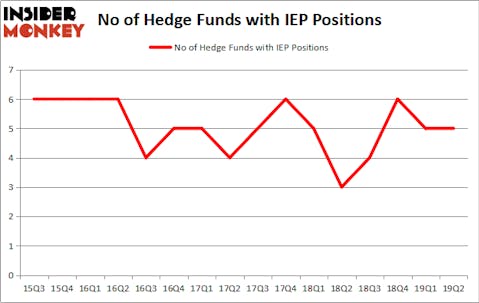

Heading into the third quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in IEP over the last 16 quarters. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Icahn Capital LP, managed by Carl Icahn, holds the number one position in Icahn Enterprises LP (NASDAQ:IEP). Icahn Capital LP has a $13.42 billion position in the stock, comprising 50.6% of its 13F portfolio. Coming in second is Horizon Asset Management, led by Murray Stahl, holding a $128.1 million position; 3.5% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions encompass Ken Griffin’s Citadel Investment Group and Robert B. Gillam’s McKinley Capital Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the second quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks similar to Icahn Enterprises LP (NASDAQ:IEP). These stocks are Huntington Bancshares Incorporated (NASDAQ:HBAN), WellCare Health Plans, Inc. (NYSE:WCG), Martin Marietta Materials, Inc. (NYSE:MLM), and Western Digital Corporation (NASDAQ:WDC). This group of stocks’ market valuations are similar to IEP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HBAN | 23 | 67157 | -5 |

| WCG | 46 | 1800255 | -1 |

| MLM | 40 | 2473921 | 4 |

| WDC | 25 | 500396 | -8 |

| Average | 33.5 | 1210432 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $1210 million. That figure was $13554 million in IEP’s case. WellCare Health Plans, Inc. (NYSE:WCG) is the most popular stock in this table. On the other hand Huntington Bancshares Incorporated (NASDAQ:HBAN) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Icahn Enterprises LP (NASDAQ:IEP) is even less popular than HBAN. Hedge funds dodged a bullet by taking a bearish stance towards IEP. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately IEP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); IEP investors were disappointed as the stock returned -8.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.