The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 887 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of HubSpot Inc (NYSE:HUBS).

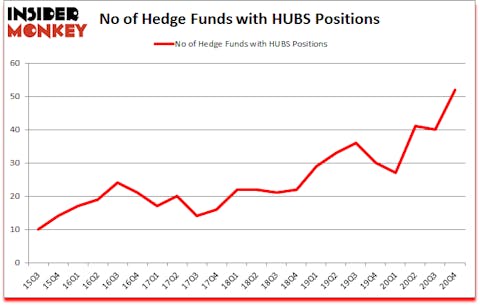

Is HUBS stock a buy or sell? HubSpot Inc (NYSE:HUBS) was in 52 hedge funds’ portfolios at the end of December. The all time high for this statistic is 41. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. HUBS shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. There were 40 hedge funds in our database with HUBS positions at the end of the third quarter. Our calculations also showed that HUBS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 197% since March 2017 and outperformed the S&P 500 ETFs by more than 124 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). Now we’re going to view the recent hedge fund action regarding HubSpot Inc (NYSE:HUBS).

Do Hedge Funds Think HUBS Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 52 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from the previous quarter. On the other hand, there were a total of 30 hedge funds with a bullish position in HUBS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, SCGE Management was the largest shareholder of HubSpot Inc (NYSE:HUBS), with a stake worth $558.2 million reported as of the end of December. Trailing SCGE Management was Citadel Investment Group, which amassed a stake valued at $211.9 million. Polar Capital, Hitchwood Capital Management, and Echo Street Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position North Peak Capital allocated the biggest weight to HubSpot Inc (NYSE:HUBS), around 10.86% of its 13F portfolio. Greenlea Lane Capital is also relatively very bullish on the stock, setting aside 9.97 percent of its 13F equity portfolio to HUBS.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the most outsized position in HubSpot Inc (NYSE:HUBS). Arrowstreet Capital had $5.4 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $5 million position during the quarter. The other funds with brand new HUBS positions are Eric Bannasch’s Cadian Capital, Anand Parekh’s Alyeska Investment Group, and Kevin McCarthy’s Breakline Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as HubSpot Inc (NYSE:HUBS) but similarly valued. We will take a look at Clarivate Plc (NYSE:CCC), The Cooper Companies, Inc. (NYSE:COO), Conagra Brands, Inc. (NYSE:CAG), Broadridge Financial Solutions, Inc. (NYSE:BR), Martin Marietta Materials, Inc. (NYSE:MLM), NovoCure Limited (NASDAQ:NVCR), and Tyler Technologies, Inc. (NYSE:TYL). All of these stocks’ market caps match HUBS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCC | 40 | 5223432 | 3 |

| COO | 31 | 1349415 | 1 |

| CAG | 28 | 634446 | -7 |

| BR | 25 | 244137 | -8 |

| MLM | 41 | 2010592 | 3 |

| NVCR | 22 | 417787 | 0 |

| TYL | 32 | 592915 | 1 |

| Average | 31.3 | 1496103 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.3 hedge funds with bullish positions and the average amount invested in these stocks was $1496 million. That figure was $1562 million in HUBS’s case. Martin Marietta Materials, Inc. (NYSE:MLM) is the most popular stock in this table. On the other hand NovoCure Limited (NASDAQ:NVCR) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks HubSpot Inc (NYSE:HUBS) is more popular among hedge funds. Our overall hedge fund sentiment score for HUBS is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks returned 5.3% in 2021 through March 19th but still managed to beat the market by 0.8 percentage points. Hedge funds were also right about betting on HUBS as the stock returned 13.1% since the end of December (through 3/19) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Hubspot Inc (NYSE:HUBS)

Follow Hubspot Inc (NYSE:HUBS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.