Is HubSpot Inc (NYSE:HUBS) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

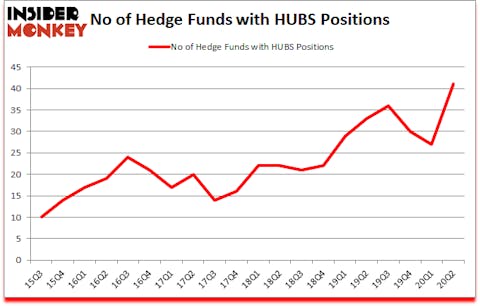

HubSpot Inc (NYSE:HUBS) shareholders have witnessed an increase in enthusiasm from smart money in recent months. HubSpot Inc (NYSE:HUBS) was in 41 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 36. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that HUBS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are assumed to be slow, old financial vehicles of yesteryear. While there are greater than 8000 funds in operation at the moment, Our experts look at the top tier of this club, approximately 850 funds. It is estimated that this group of investors command most of the hedge fund industry’s total capital, and by observing their highest performing picks, Insider Monkey has discovered a few investment strategies that have historically surpassed the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

David Siegel of Two Sigma Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to analyze the latest hedge fund action surrounding HubSpot Inc (NYSE:HUBS).

How have hedgies been trading HubSpot Inc (NYSE:HUBS)?

Heading into the third quarter of 2020, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 52% from the previous quarter. By comparison, 33 hedge funds held shares or bullish call options in HUBS a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, SCGE Management held the most valuable stake in HubSpot Inc (NYSE:HUBS), which was worth $315.9 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $93.9 million worth of shares. North Peak Capital, Two Sigma Advisors, and Hitchwood Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position North Peak Capital allocated the biggest weight to HubSpot Inc (NYSE:HUBS), around 20.12% of its 13F portfolio. SCGE Management is also relatively very bullish on the stock, dishing out 6.1 percent of its 13F equity portfolio to HUBS.

Now, some big names were breaking ground themselves. Echo Street Capital Management, managed by Greg Poole, created the largest position in HubSpot Inc (NYSE:HUBS). Echo Street Capital Management had $29.7 million invested in the company at the end of the quarter. Girish Kumar’s TenCore Partners also initiated a $10.5 million position during the quarter. The following funds were also among the new HUBS investors: Richard SchimeláandáLawrence Sapanski’s Cinctive Capital Management, Highbridge Capital Management, and Robert Henry Lynch’s Aristeia Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as HubSpot Inc (NYSE:HUBS) but similarly valued. These stocks are Avantor, Inc. (NYSE:AVTR), Qiagen NV (NYSE:QGEN), China Southern Airlines Co Ltd (NYSE:ZNH), RPM International Inc. (NYSE:RPM), The Carlyle Group Inc. (NASDAQ:CG), Magellan Midstream Partners, L.P. (NYSE:MMP), and ASE Technology Holding Co., Ltd. (NYSE:ASX). This group of stocks’ market values match HUBS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVTR | 34 | 646574 | 5 |

| QGEN | 32 | 652397 | 2 |

| ZNH | 2 | 7852 | 0 |

| RPM | 26 | 108615 | 4 |

| CG | 8 | 171536 | -8 |

| MMP | 15 | 59070 | 2 |

| ASX | 11 | 167226 | 2 |

| Average | 18.3 | 259039 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.3 hedge funds with bullish positions and the average amount invested in these stocks was $259 million. That figure was $868 million in HUBS’s case. Avantor, Inc. (NYSE:AVTR) is the most popular stock in this table. On the other hand China Southern Airlines Co Ltd (NYSE:ZNH) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks HubSpot Inc (NYSE:HUBS) is more popular among hedge funds. Our overall hedge fund sentiment score for HUBS is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 30% in 2020 through October 23rd but still managed to beat the market by 21 percentage points. Hedge funds were also right about betting on HUBS as the stock returned 40.7% since the end of June (through 10/23) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Hubspot Inc (NYSE:HUBS)

Follow Hubspot Inc (NYSE:HUBS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.