Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the successful investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the successful funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Host Hotels and Resorts Inc (NYSE:HST) .

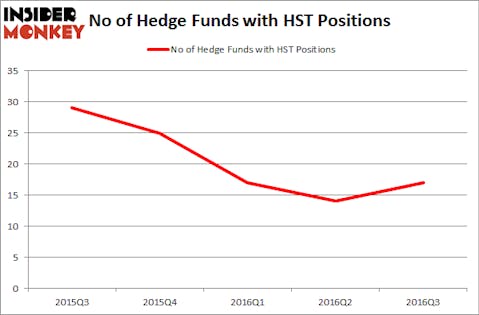

Is Host Hotels and Resorts Inc (NYSE:HST) a buy right now? The smart money seems to be in a bullish mood, since the number of long hedge fund positions that are disclosed in regulatory 13F filings improved by three last quarter. At the end of September, 17 funds followed by Insider Monkey held long positions in HST. At the end of this article we will also compare HST to other stocks including Skyworks Solutions Inc (NASDAQ:SWKS), Vodafone Group Plc (ADR) (NASDAQ:VOD), and Cabot Oil & Gas Corporation (NYSE:COG) to get a better sense of its popularity.

Follow Host Hotels & Resorts Inc. (NASDAQ:HST)

Follow Host Hotels & Resorts Inc. (NASDAQ:HST)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kaspars Grinvalds/Shutterstock.com

With all of this in mind, we’re going to take a peek at the new action encompassing Host Hotels and Resorts Inc (NYSE:HST).

What have hedge funds been doing with Host Hotels and Resorts Inc (NYSE:HST)?

Heading into the fourth quarter of 2016, a total of 17 of the hedge funds tracked by Insider Monkey were long Host Hotels and Resorts Inc (NYSE:HST), up by 21% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards HST over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jeffrey Furber’s AEW Capital Management has the most valuable position in Host Hotels and Resorts Inc (NYSE:HST), worth close to $128.8 million, corresponding to 2.7% of its total 13F portfolio. The second most bullish fund manager is Israel Englander’s Millennium Management holding a $22.8 million position; less than 0.1% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish encompass Phill Gross and Robert Atchinson’s Adage Capital Management and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, key money managers have been driving this bullishness. Clinton Group, led by George Hall, created the largest position in Host Hotels and Resorts Inc (NYSE:HST). Clinton Group had $15.7 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $10.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Benjamin A. Smith’s Laurion Capital Management, Ken Griffin’s Citadel Investment Group, and Matthew Tewksbury’s Stevens Capital Management.

Let’s go over hedge fund activity in other stocks similar to Host Hotels and Resorts Inc (NYSE:HST). These stocks are Skyworks Solutions Inc (NASDAQ:SWKS), Vodafone Group Plc (ADR) (NASDAQ:VOD), Cabot Oil & Gas Corporation (NYSE:COG), and Agnico-Eagle Mines Limited (USA) (NYSE:AEM). This group of stocks’ market valuations resemble HST’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWKS | 32 | 457924 | -1 |

| VOD | 18 | 445786 | -4 |

| COG | 35 | 1797666 | -1 |

| AEM | 25 | 500237 | -4 |

As you can see these stocks had an average of 28 funds with bullish positions and the average amount invested in these stocks was $800 million. That figure was $228 million in HST’s case. Cabot Oil & Gas Corporation (NYSE:COG) is the most popular stock in this table. On the other hand Vodafone Group Plc (ADR) (NASDAQ:VOD) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Host Hotels and Resorts Inc (NYSE:HST) is even less popular than Vodafone Group Plc (ADR) (NASDAQ:VOD). Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Best Selling Consumer Products in India

Top New World Order Facts

Dirtiest Countries In Europe

Disclosure: None