Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

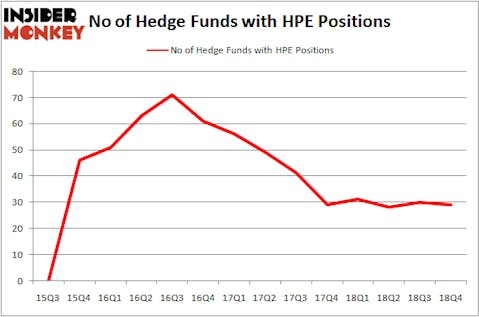

Is Hewlett Packard Enterprise Company (NYSE:HPE) a buy, sell, or hold? The best stock pickers are getting less bullish. The number of bullish hedge fund positions went down by 1 recently. Our calculations also showed that HPE isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several indicators stock traders employ to assess their holdings. Some of the most useful indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can trounce their index-focused peers by a healthy margin (see the details here).

Let’s take a glance at the recent hedge fund action regarding Hewlett Packard Enterprise Company (NYSE:HPE).

What have hedge funds been doing with Hewlett Packard Enterprise Company (NYSE:HPE)?

At the end of the fourth quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from the second quarter of 2018. By comparison, 31 hedge funds held shares or bullish call options in HPE a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Pzena Investment Management, managed by Richard S. Pzena, holds the number one position in Hewlett Packard Enterprise Company (NYSE:HPE). Pzena Investment Management has a $454.1 million position in the stock, comprising 2.7% of its 13F portfolio. The second most bullish fund manager is Two Sigma Advisors, managed by John Overdeck and David Siegel, which holds a $92 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Israel Englander’s Millennium Management, Mario Gabelli’s GAMCO Investors and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Since Hewlett Packard Enterprise Company (NYSE:HPE) has witnessed bearish sentiment from the smart money, logic holds that there is a sect of hedgies that decided to sell off their full holdings in the third quarter. At the top of the heap, Jonathan Barrett and Paul Segal’s Luminus Management cut the largest stake of the “upper crust” of funds tracked by Insider Monkey, valued at close to $8.2 million in stock, and Charles Lemonides’s Valueworks LLC was right behind this move, as the fund dumped about $2.1 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Hewlett Packard Enterprise Company (NYSE:HPE). These stocks are Newmont Mining Corp (NYSE:NEM), Advanced Micro Devices, Inc. (NASDAQ:AMD), SBA Communications Corporation (NASDAQ:SBAC), and ORIX Corporation (NYSE:IX). This group of stocks’ market caps are similar to HPE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEM | 31 | 405612 | 5 |

| AMD | 28 | 339975 | 0 |

| SBAC | 32 | 1489281 | 0 |

| IX | 7 | 7094 | 1 |

| Average | 24.5 | 560491 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $560 million. That figure was $832 million in HPE’s case. SBA Communications Corporation (NASDAQ:SBAC) is the most popular stock in this table. On the other hand ORIX Corporation (NYSE:IX) is the least popular one with only 7 bullish hedge fund positions. Hewlett Packard Enterprise Company (NYSE:HPE) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on HPE as the stock returned 22.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.