Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

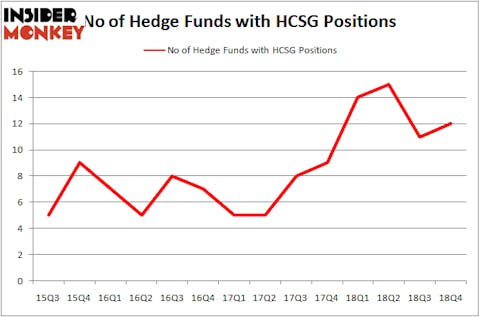

Healthcare Services Group, Inc. (NASDAQ:HCSG) shareholders have witnessed an increase in enthusiasm from smart money in recent months. Our calculations also showed that HCSG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the recent hedge fund action encompassing Healthcare Services Group, Inc. (NASDAQ:HCSG).

How are hedge funds trading Healthcare Services Group, Inc. (NASDAQ:HCSG)?

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from one quarter earlier. By comparison, 14 hedge funds held shares or bullish call options in HCSG a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Healthcare Services Group, Inc. (NASDAQ:HCSG), which was worth $11.1 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $6.6 million worth of shares. Moreover, Markel Gayner Asset Management, Balyasny Asset Management, and Millennium Management were also bullish on Healthcare Services Group, Inc. (NASDAQ:HCSG), allocating a large percentage of their portfolios to this stock.

Now, key money managers have jumped into Healthcare Services Group, Inc. (NASDAQ:HCSG) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the most valuable position in Healthcare Services Group, Inc. (NASDAQ:HCSG). Balyasny Asset Management had $3.2 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $1 million investment in the stock during the quarter. The only other fund with a new position in the stock is Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Healthcare Services Group, Inc. (NASDAQ:HCSG) but similarly valued. We will take a look at Banco Macro SA (NYSE:BMA), Cornerstone OnDemand, Inc. (NASDAQ:CSOD), TriNet Group Inc (NYSE:TNET), and Mednax Inc. (NYSE:MD). This group of stocks’ market valuations are similar to HCSG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMA | 17 | 174348 | 5 |

| CSOD | 31 | 601148 | 3 |

| TNET | 17 | 233555 | -4 |

| MD | 25 | 480820 | 0 |

| Average | 22.5 | 372468 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $372 million. That figure was $35 million in HCSG’s case. Cornerstone OnDemand, Inc. (NASDAQ:CSOD) is the most popular stock in this table. On the other hand Banco Macro SA (NYSE:BMA) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Healthcare Services Group, Inc. (NASDAQ:HCSG) is even less popular than BMA. Hedge funds dodged a bullet by taking a bearish stance towards HCSG. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HCSG wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); HCSG investors were disappointed as the stock returned -16.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.