A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Green Brick Partners Inc (NASDAQ:GRBK).

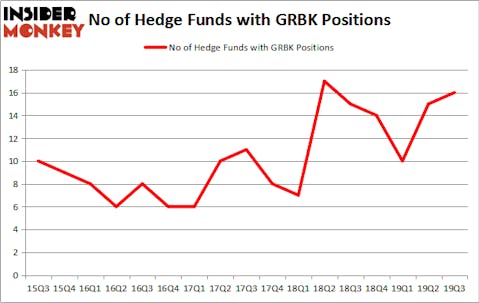

Green Brick Partners Inc (NASDAQ:GRBK) investors should pay attention to an increase in hedge fund interest recently. GRBK was in 16 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with GRBK positions at the end of the previous quarter. Our calculations also showed that GRBK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are dozens of indicators shareholders can use to evaluate their holdings. A duo of the most useful indicators are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top fund managers can outpace the S&P 500 by a superb margin (see the details here).

David Einhorn of Greenlight Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the recent hedge fund action surrounding Green Brick Partners Inc (NASDAQ:GRBK).

How have hedgies been trading Green Brick Partners Inc (NASDAQ:GRBK)?

Heading into the fourth quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards GRBK over the last 17 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Green Brick Partners Inc (NASDAQ:GRBK) was held by Greenlight Capital, which reported holding $258.1 million worth of stock at the end of September. It was followed by Stadium Capital Management with a $16.4 million position. Other investors bullish on the company included Birch Run Capital, Diamond Hill Capital, and Ariel Investments. In terms of the portfolio weights assigned to each position Greenlight Capital allocated the biggest weight to Green Brick Partners Inc (NASDAQ:GRBK), around 18.57% of its 13F portfolio. Stadium Capital Management is also relatively very bullish on the stock, earmarking 9.87 percent of its 13F equity portfolio to GRBK.

As aggregate interest increased, key hedge funds were breaking ground themselves. Marshall Wace, managed by Paul Marshall and Ian Wace, assembled the most valuable position in Green Brick Partners Inc (NASDAQ:GRBK). Marshall Wace had $0.3 million invested in the company at the end of the quarter. Renaissance Technologies also made a $0.3 million investment in the stock during the quarter. The only other fund with a new position in the stock is Peter Algert and Kevin Coldiron’s Algert Coldiron Investors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Green Brick Partners Inc (NASDAQ:GRBK) but similarly valued. We will take a look at Oasis Midstream Partners LP (NYSE:OMP), Party City Holdco Inc (NYSE:PRTY), First Community Bankshares Inc (NASDAQ:FCBC), and Organigram Holdings Inc. (NASDAQ:OGI). This group of stocks’ market caps resemble GRBK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMP | 3 | 7122 | -2 |

| PRTY | 10 | 77943 | 0 |

| FCBC | 8 | 12241 | 5 |

| OGI | 6 | 2915 | 1 |

| Average | 6.75 | 25055 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $318 million in GRBK’s case. Party City Holdco Inc (NYSE:PRTY) is the most popular stock in this table. On the other hand Oasis Midstream Partners LP (NYSE:OMP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Green Brick Partners Inc (NASDAQ:GRBK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on GRBK, though not to the same extent, as the stock returned 6.6% during the fourth quarter (through the end of November) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.