Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Globe Life Inc. (NYSE:GL).

Hedge fund interest in Globe Life Inc. (NYSE:GL) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as VICI Properties Inc. (NYSE:VICI), RingCentral Inc (NYSE:RNG), and Wayfair Inc (NYSE:W) to gather more data points. Our calculations also showed that GL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most shareholders, hedge funds are assumed to be slow, outdated financial tools of the past. While there are over 8000 funds with their doors open today, We choose to focus on the masters of this group, approximately 750 funds. These hedge fund managers orchestrate bulk of all hedge funds’ total asset base, and by shadowing their best stock picks, Insider Monkey has deciphered a number of investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Warren Buffett of Berkshire Hathaway

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the latest hedge fund action surrounding Globe Life Inc. (NYSE:GL).

What does smart money think about Globe Life Inc. (NYSE:GL)?

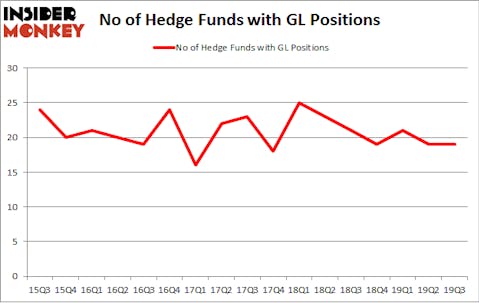

Heading into the fourth quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in GL a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Berkshire Hathaway, managed by Warren Buffett, holds the number one position in Globe Life Inc. (NYSE:GL). Berkshire Hathaway has a $608.4 million position in the stock, comprising 0.3% of its 13F portfolio. Sitting at the No. 2 spot is Citadel Investment Group, led by Ken Griffin, holding a $92 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism contain Richard S. Pzena’s Pzena Investment Management, John D. Gillespie’s Prospector Partners and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position Prospector Partners allocated the biggest weight to Globe Life Inc. (NYSE:GL), around 3.04% of its 13F portfolio. Prana Capital Management is also relatively very bullish on the stock, earmarking 0.79 percent of its 13F equity portfolio to GL.

Seeing as Globe Life Inc. (NYSE:GL) has witnessed declining sentiment from hedge fund managers, logic holds that there exists a select few funds that elected to cut their full holdings by the end of the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management dropped the biggest investment of the 750 funds monitored by Insider Monkey, worth an estimated $3.9 million in call options. Gregg Moskowitz’s fund, Interval Partners, also dumped its call options, about $2.7 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Globe Life Inc. (NYSE:GL). We will take a look at VICI Properties Inc. (NYSE:VICI), RingCentral Inc (NYSE:RNG), Wayfair Inc (NYSE:W), and Federal Realty Investment Trust (NYSE:FRT). All of these stocks’ market caps are closest to GL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VICI | 37 | 2262889 | -22 |

| RNG | 48 | 1615607 | 3 |

| W | 30 | 1831086 | -2 |

| FRT | 22 | 146584 | -1 |

| Average | 34.25 | 1464042 | -5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $1464 million. That figure was $829 million in GL’s case. RingCentral Inc (NYSE:RNG) is the most popular stock in this table. On the other hand Federal Realty Investment Trust (NYSE:FRT) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Globe Life Inc. (NYSE:GL) is even less popular than FRT. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on GL, though not to the same extent, as the stock returned 7.5% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.