Artisan Partners, a high value-added investment management firm, published its ‘Artisan International Value Fund’ third quarter 2021 investor letter – a copy of which can be downloaded here. A return of -2.84% was recorded by its Investor Class: ARTKX, -2.82% by its Advisor Class: APDKX, and -2.79% by its Institutional Class: APHKX for the third quarter of 2021, all compared to the MSCI EAFE Index that delivered a -0.45% return and the MSCI All Country World ex USA Index that was down by -2.99% for the same period. You can take a look at the fund’s top 5 holdings to have an idea about their best picks for 2021.

Artisan International Value Fund, in its Q3 2021 investor letter, mentioned Fresenius Medical Care AG & Co. KGaA (NYSE: FMS) and discussed its stance on the firm. Fresenius Medical Care AG & Co. KGaA is a Bad Homburg, Germany-based healthcare company with an $18.2 billion market capitalization. FMS delivered a -25.07% return since the beginning of the year, while its 12-month returns are down by -26.28%. The stock closed at $31.14 per share on November 22, 2021.

Here is what Artisan International Value Fund has to say about Fresenius Medical Care AG & Co. KGaA in its Q3 2021 investor letter:

“Fresenius Medical Care is the world’s largest provider of kidney dialysis products and services. The company dominates the sale of equipment used in kidney dialysis and runs an effective duopoly in the provision of dialysis services in the US. COVID has had a significant negative impact on the company’s business in the form of both higher patient mortality and increased costs. And the company has made some capital allocation and operating errors that have reduced profits in what should be a growing, utility-like earnings stream. The share price fell 13% during the quarter. We are communicating with management and the board on resolving some of the company’s issues. Also, the new chairman of the company’s ultimate holding company is demanding better performance. As the demand for treatment of kidney failure remains a growing market around the globe, the company’s patient base will naturally be restored, and the equipment business will continue growing. Better execution should lead to better financial performance over the next few years.”

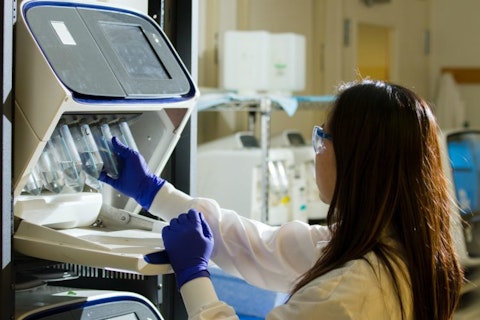

national-cancer-institute-GcrSgHDrniY-unsplash

Based on our calculations, Fresenius Medical Care AG & Co. KGaA (NYSE: FMS) was not able to clinch a spot in our list of the 30 Most Popular Stocks Among Hedge Funds. FMS was in 4 hedge fund portfolios at the end of the third quarter of 2021, compared to 5 funds in the previous quarter. Fresenius Medical Care AG & Co. KGaA (NYSE: FMS) delivered a -22.77% return in the past 3 months.

Disclosure: None. This article is originally published at Insider Monkey.