Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 12.1% in 2019 (through May 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 18.7% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Forward Air Corporation (NASDAQ:FWRD).

Forward Air Corporation (NASDAQ:FWRD) investors should pay attention to an increase in hedge fund sentiment of late. FWRD was in 15 hedge funds’ portfolios at the end of March. There were 11 hedge funds in our database with FWRD positions at the end of the previous quarter. Our calculations also showed that fwrd isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are perceived as slow, outdated financial tools of years past. While there are more than 8000 funds in operation today, We look at the masters of this club, about 750 funds. These hedge fund managers watch over the majority of all hedge funds’ total asset base, and by shadowing their first-class investments, Insider Monkey has revealed various investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s go over the fresh hedge fund action encompassing Forward Air Corporation (NASDAQ:FWRD).

Hedge fund activity in Forward Air Corporation (NASDAQ:FWRD)

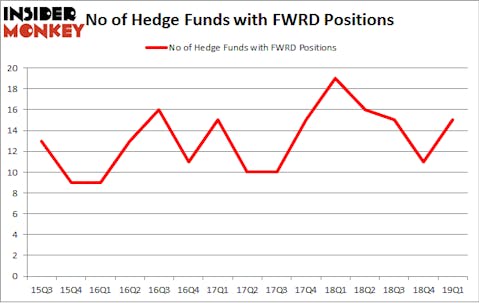

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 36% from the previous quarter. The graph below displays the number of hedge funds with bullish position in FWRD over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in Forward Air Corporation (NASDAQ:FWRD), which was worth $60.6 million at the end of the first quarter. On the second spot was GLG Partners which amassed $14.9 million worth of shares. Moreover, Arrowstreet Capital, Winton Capital Management, and Citadel Investment Group were also bullish on Forward Air Corporation (NASDAQ:FWRD), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in Forward Air Corporation (NASDAQ:FWRD). Arrowstreet Capital had $6.8 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $4 million investment in the stock during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, Dmitry Balyasny’s Balyasny Asset Management, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Forward Air Corporation (NASDAQ:FWRD) but similarly valued. We will take a look at HudBay Minerals Inc (NYSE:HBM), Avaya Holdings Corp. (NYSE:AVYA), Itron, Inc. (NASDAQ:ITRI), and Flagstar Bancorp Inc (NYSE:FBC). This group of stocks’ market values are closest to FWRD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HBM | 11 | 295270 | -2 |

| AVYA | 40 | 427447 | 4 |

| ITRI | 15 | 415956 | 1 |

| FBC | 14 | 77882 | 2 |

| Average | 20 | 304139 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $304 million. That figure was $102 million in FWRD’s case. Avaya Holdings Corp. (NYSE:AVYA) is the most popular stock in this table. On the other hand HudBay Minerals Inc (NYSE:HBM) is the least popular one with only 11 bullish hedge fund positions. Forward Air Corporation (NASDAQ:FWRD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FWRD wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); FWRD investors were disappointed as the stock returned -9.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.