Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

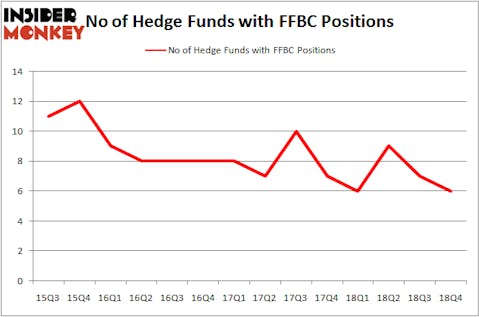

First Financial Bancorp (NASDAQ:FFBC) was in 6 hedge funds’ portfolios at the end of December. FFBC shareholders have witnessed a decrease in hedge fund sentiment of late. There were 7 hedge funds in our database with FFBC positions at the end of the previous quarter. Our calculations also showed that FFBC isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action surrounding First Financial Bancorp (NASDAQ:FFBC).

How are hedge funds trading First Financial Bancorp (NASDAQ:FFBC)?

At Q4’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the second quarter of 2018. On the other hand, there were a total of 6 hedge funds with a bullish position in FFBC a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in First Financial Bancorp (NASDAQ:FFBC), which was worth $13.6 million at the end of the third quarter. On the second spot was Balyasny Asset Management which amassed $2.3 million worth of shares. Moreover, PEAK6 Capital Management, Millennium Management, and Weld Capital Management were also bullish on First Financial Bancorp (NASDAQ:FFBC), allocating a large percentage of their portfolios to this stock.

Since First Financial Bancorp (NASDAQ:FFBC) has faced a decline in interest from the aggregate hedge fund industry, logic holds that there were a few money managers who sold off their full holdings last quarter. At the top of the heap, Noam Gottesman’s GLG Partners dropped the biggest position of the 700 funds tracked by Insider Monkey, comprising an estimated $2.2 million in stock, and Cliff Asness’s AQR Capital Management was right behind this move, as the fund said goodbye to about $1.4 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as First Financial Bancorp (NASDAQ:FFBC) but similarly valued. These stocks are iRobot Corporation (NASDAQ:IRBT), BBVA Banco Frances S.A. (NYSE:BFR), Repligen Corporation (NASDAQ:RGEN), and Norbord Inc. (NYSE:OSB). This group of stocks’ market caps match FFBC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IRBT | 14 | 79814 | 4 |

| BFR | 13 | 30134 | 6 |

| RGEN | 22 | 78494 | 10 |

| OSB | 7 | 18516 | -3 |

| Average | 14 | 51740 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $17 million in FFBC’s case. Repligen Corporation (NASDAQ:RGEN) is the most popular stock in this table. On the other hand Norbord Inc. (NYSE:OSB) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks First Financial Bancorp (NASDAQ:FFBC) is even less popular than OSB. Hedge funds dodged a bullet by taking a bearish stance towards FFBC. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FFBC wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); FFBC investors were disappointed as the stock returned 4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.