After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards F.N.B. Corp (NYSE:FNB).

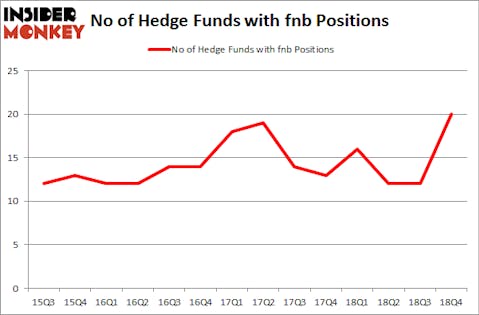

F.N.B. Corp (NYSE:FNB) has experienced an increase in hedge fund interest of late. FNB was in 20 hedge funds’ portfolios at the end of December. There were 12 hedge funds in our database with FNB positions at the end of the previous quarter. Our calculations also showed that fnb isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the new hedge fund action encompassing F.N.B. Corp (NYSE:FNB).

What does the smart money think about F.N.B. Corp (NYSE:FNB)?

At the end of the fourth quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 67% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FNB over the last 14 quarters. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

More specifically, EJF Capital was the largest shareholder of F.N.B. Corp (NYSE:FNB), with a stake worth $25.4 million reported as of the end of September. Trailing EJF Capital was Basswood Capital, which amassed a stake valued at $18.5 million. Arrowstreet Capital, Renaissance Technologies, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the most valuable position in F.N.B. Corp (NYSE:FNB). Arrowstreet Capital had $10.7 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $8.4 million position during the quarter. The following funds were also among the new FNB investors: Ken Griffin’s Citadel Investment Group, D. E. Shaw’s D E Shaw, and Matthew Tewksbury’s Stevens Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as F.N.B. Corp (NYSE:FNB) but similarly valued. We will take a look at National Health Investors Inc (NYSE:NHI), Two Harbors Investment Corp (NYSE:TWO), Weingarten Realty Investors (NYSE:WRI), and Pluralsight, Inc. (NASDAQ:PS). This group of stocks’ market valuations are similar to FNB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NHI | 13 | 98672 | 3 |

| TWO | 16 | 44988 | 2 |

| WRI | 12 | 46342 | 1 |

| PS | 15 | 92526 | 2 |

| Average | 14 | 70632 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $71 million. That figure was $85 million in FNB’s case. Two Harbors Investment Corp (NYSE:TWO) is the most popular stock in this table. On the other hand Weingarten Realty Investors (NYSE:WRI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks F.N.B. Corp (NYSE:FNB) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FNB wasn’t nearly as popular as these 15 stock and hedge funds that were betting on FNB were disappointed as the stock returned 14% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.