The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Endo International plc (NASDAQ:ENDP) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

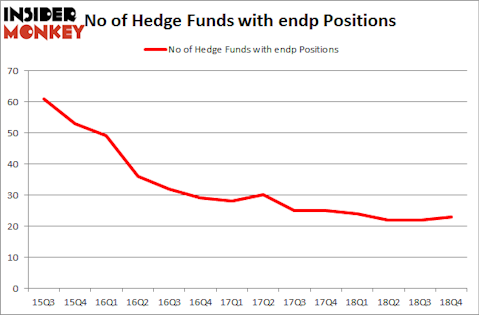

Endo International plc (NASDAQ:ENDP) has seen an increase in support from the world’s most elite money managers of late. ENDP was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 22 hedge funds in our database with ENDP positions at the end of the previous quarter. Our calculations also showed that endp isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the new hedge fund action surrounding Endo International plc (NASDAQ:ENDP).

What have hedge funds been doing with Endo International plc (NASDAQ:ENDP)?

Heading into the first quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ENDP over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Endo International plc (NASDAQ:ENDP), with a stake worth $85.4 million reported as of the end of December. Trailing Renaissance Technologies was Paulson & Co, which amassed a stake valued at $63 million. Glenview Capital, D E Shaw, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Weld Capital Management, managed by Minhua Zhang, initiated the most outsized position in Endo International plc (NASDAQ:ENDP). Weld Capital Management had $0.5 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $0.5 million position during the quarter. The other funds with brand new ENDP positions are Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners and Joe DiMenna’s ZWEIG DIMENNA PARTNERS.

Let’s go over hedge fund activity in other stocks similar to Endo International plc (NASDAQ:ENDP). We will take a look at Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN), BancFirst Corporation (NASDAQ:BANF), FBL Financial Group, Inc. (NYSE:FFG), and BP Midstream Partners LP (NYSE:BPMP). This group of stocks’ market valuations are closest to ENDP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHVN | 22 | 324574 | 4 |

| BANF | 9 | 40349 | 2 |

| FFG | 6 | 4443 | 2 |

| BPMP | 3 | 42610 | -1 |

| Average | 10 | 102994 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $103 million. That figure was $269 million in ENDP’s case. Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) is the most popular stock in this table. On the other hand BP Midstream Partners LP (NYSE:BPMP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Endo International plc (NASDAQ:ENDP) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ENDP wasn’t nearly as popular as these 15 stock and hedge funds that were betting on ENDP were disappointed as the stock returned -2.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.