Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

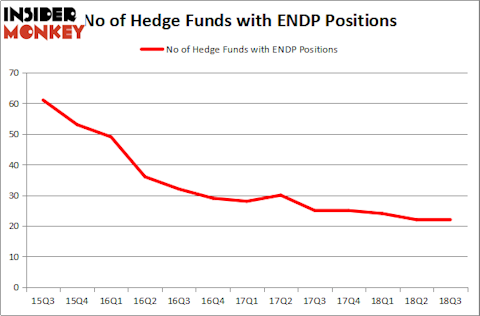

Endo International plc (NASDAQ:ENDP) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as John Bean Technologies Corporation (NYSE:JBT), United Bankshares, Inc. (NASDAQ:UBSI), and Eldorado Resorts Inc (NASDAQ:ERI) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

While collecting data for our write-up, we came across Miller Value Partners’ third-quarter 2018 letter to shareholders, that gives its opinion on Endo International. The fund said the company was a positive net contributor to the fund and had this to say about it in the letter:

“Supervalu along with our holdings in Endo International (ENDP) and Unisys (UIS) were significant positive contributors during the quarter pushing the Deep Value strategies ahead of the S&P 500.”

Our readers will be interested to know that Joseph Matthew Maletta, EVP and Chief Legal Officer at the company, was responsible for the last major insider purchase of Endo International common stock, snapping up 3,000 shares at $8.02 per share in 2017. With the stock currently trading at $10.19, it was certainly a lucrative purchase.

What does the smart money think about Endo International plc (NASDAQ:ENDP)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, no change from one quarter earlier. The graph below displays the number of hedge funds with a bullish position in ENDP over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Glenview Capital was the largest shareholder of Endo International plc (NASDAQ:ENDP), with a stake worth $219.2 million reported as of the end of September. Trailing Glenview Capital was Renaissance Technologies, which amassed a stake valued at $161.7 million. Paulson & Co, D E Shaw, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Endo International plc (NASDAQ:ENDP) has experienced falling interest from hedge fund managers, it’s easy to see that there were a few funds who sold off their full holdings last quarter. Interestingly, Kevin Kotler’s Broadfin Capital cut the largest stake of all the hedgies followed by Insider Monkey, comprising about $24.4 million in stock, and Stephen DuBois’s Camber Capital Management was right behind this move, as the fund sold off about $23.6 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Endo International plc (NASDAQ:ENDP) but similarly valued. We will take a look at John Bean Technologies Corporation (NYSE:JBT), United Bankshares, Inc. (NASDAQ:UBSI), Eldorado Resorts Inc (NASDAQ:ERI), and Patterson-UTI Energy, Inc. (NASDAQ:PTEN). This group of stocks’ market values match ENDP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBT | 13 | 39442 | 2 |

| UBSI | 7 | 38546 | 1 |

| ERI | 24 | 969564 | -3 |

| PTEN | 31 | 472104 | -7 |

| Average | 18.75 | 379914 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $380 million. That figure was $775 million in ENDP’s case. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is the most popular stock in this table. On the other hand United Bankshares, Inc. (NASDAQ:UBSI) is the least popular one with only 7 bullish hedge fund positions. Endo International plc (NASDAQ:ENDP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PTEN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.