Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Editas Medicine, Inc. (NASDAQ:EDIT) to find out whether it was one of their high conviction long-term ideas.

Editas Medicine, Inc. (NASDAQ:EDIT) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. At the end of this article we will also compare EDIT to other stocks including First Busey Corporation (NASDAQ:BUSE), Mirati Therapeutics, Inc. (NASDAQ:MRTX), and Royce Value Trust, Inc. (NYSE:RVT) to get a better sense of its popularity.

According to most traders, hedge funds are assumed to be underperforming, outdated financial tools of yesteryear. While there are over 8,000 funds in operation at present, Our researchers look at the leaders of this club, around 700 funds. Most estimates calculate that this group of people watch over the majority of the hedge fund industry’s total asset base, and by monitoring their matchless equity investments, Insider Monkey has brought to light a few investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the fresh hedge fund action encompassing Editas Medicine, Inc. (NASDAQ:EDIT).

What have hedge funds been doing with Editas Medicine, Inc. (NASDAQ:EDIT)?

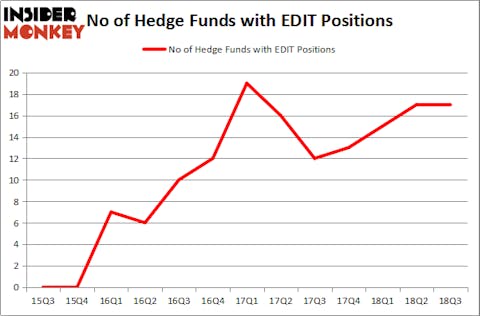

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in EDIT over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Deerfield Management held the most valuable stake in Editas Medicine, Inc. (NASDAQ:EDIT), which was worth $36.9 million at the end of the third quarter. On the second spot was Viking Global which amassed $29.6 million worth of shares. Moreover, D E Shaw, Casdin Capital, and Valiant Capital were also bullish on Editas Medicine, Inc. (NASDAQ:EDIT), allocating a large percentage of their portfolios to this stock.

Due to the fact that Editas Medicine, Inc. (NASDAQ:EDIT) has faced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few fund managers that elected to cut their entire stakes in the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management said goodbye to the biggest position of the 700 funds watched by Insider Monkey, worth close to $0.4 million in stock. Noam Gottesman’s fund, GLG Partners, also dumped its stock, about $0.3 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Editas Medicine, Inc. (NASDAQ:EDIT) but similarly valued. We will take a look at First Busey Corporation (NASDAQ:BUSE), Mirati Therapeutics, Inc. (NASDAQ:MRTX), Royce Value Trust, Inc. (NYSE:RVT), and S & T Bancorp Inc (NASDAQ:STBA). This group of stocks’ market caps are similar to EDIT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BUSE | 14 | 52759 | 1 |

| MRTX | 24 | 661199 | 5 |

| RVT | 2 | 13939 | -1 |

| STBA | 6 | 3591 | -1 |

| Average | 11.5 | 182872 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $183 million. That figure was $148 million in EDIT’s case. Mirati Therapeutics, Inc. (NASDAQ:MRTX) is the most popular stock in this table. On the other hand Royce Value Trust, Inc. (NYSE:RVT) is the least popular one with only 2 bullish hedge fund positions. Editas Medicine, Inc. (NASDAQ:EDIT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MRTX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.