You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

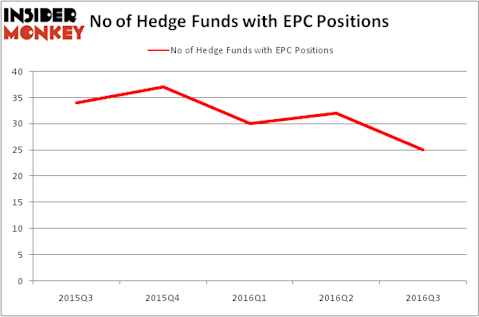

Edgewell Personal Care Co (NYSE:EPC) has experienced a decrease in hedge fund interest of late. EPC was in 25 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with EPC positions at the end of the previous quarter. At the end of this article we will also compare EPC to other stocks including Godaddy Inc (NYSE:GDDY), Sonoco Products Company (NYSE:SON), and Vail Resorts, Inc. (NYSE:MTN) to get a better sense of its popularity.

Follow Edgewell Personal Care Co (NYSE:EPC)

Follow Edgewell Personal Care Co (NYSE:EPC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, let’s view the latest action surrounding Edgewell Personal Care Co (NYSE:EPC).

How are hedge funds trading Edgewell Personal Care Co (NYSE:EPC)?

At the end of the third quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, down 22% from the previous quarter. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Mario Gabelli’s GAMCO Investors has the biggest position in Edgewell Personal Care Co (NYSE:EPC), worth close to $149.6 million, amounting to 1% of its total 13F portfolio. The second largest stake is held by York Capital Management, run by James Dinan, which holds a $63.8 million position; the fund has 2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Ric Dillon’s Diamond Hill Capital and D. E. Shaw’s D E Shaw.

Since Edgewell Personal Care Co (NYSE:EPC) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of hedgies that slashed their full holdings last quarter. Interestingly, Kenneth Mario Garschina’s Mason Capital Management sold off the biggest position of the “upper crust” of funds monitored by Insider Monkey, comprising about $31.2 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund dropped about $25.6 million worth of EPC shares. These bearish behaviors are interesting, as total hedge fund interest was cut by 7 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Edgewell Personal Care Co (NYSE:EPC). These stocks are Godaddy Inc (NYSE:GDDY), Sonoco Products Company (NYSE:SON), Vail Resorts, Inc. (NYSE:MTN), and AptarGroup, Inc. (NYSE:ATR). This group of stocks’ market values are similar to EPC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDDY | 23 | 1283096 | 0 |

| SON | 17 | 88252 | 1 |

| MTN | 35 | 497137 | 2 |

| ATR | 12 | 81379 | -5 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $487 million. That figure was $509 million in EPC’s case. Vail Resorts, Inc. (NYSE:MTN) is the most popular stock in this table. On the other hand AptarGroup, Inc. (NYSE:ATR) is the least popular one with only 12 bullish hedge fund positions. Edgewell Personal Care Co (NYSE:EPC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MTN might be a better candidate to consider a long position.

Suggested Articles:

Countries That Consume The Most Chicken

Smartphones With Best Video Recording

Most Popular Songs Of All Time

Disclosure: None