Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the fourth quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 6 years and analyze what the smart money thinks of Duck Creek Technologies, Inc. (NASDAQ:DCT) based on that data.

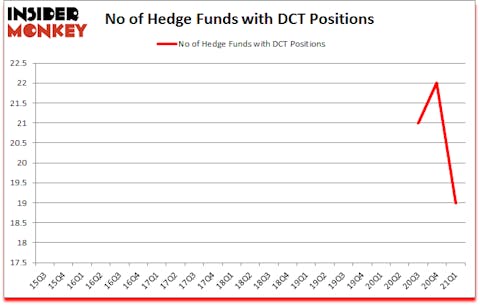

Is DCT a good stock to buy? Duck Creek Technologies, Inc. (NASDAQ:DCT) has seen a decrease in activity from the world’s largest hedge funds in recent months. Duck Creek Technologies, Inc. (NASDAQ:DCT) was in 19 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 22. There were 22 hedge funds in our database with DCT holdings at the end of December. Our calculations also showed that DCT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are many tools shareholders can use to analyze stocks. A pair of the best tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outperform the broader indices by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Chase Coleman of Tiger Global

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s go over the latest hedge fund action encompassing Duck Creek Technologies, Inc. (NASDAQ:DCT).

Do Hedge Funds Think DCT Is A Good Stock To Buy Now?

At first quarter’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from the previous quarter. On the other hand, there were a total of 0 hedge funds with a bullish position in DCT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Whale Rock Capital Management, managed by Alex Sacerdote, holds the largest position in Duck Creek Technologies, Inc. (NASDAQ:DCT). Whale Rock Capital Management has a $101.5 million position in the stock, comprising 0.8% of its 13F portfolio. Sitting at the No. 2 spot is Echo Street Capital Management, led by Greg Poole, holding a $60 million position; 0.5% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions comprise Ken Griffin’s Citadel Investment Group, Robert Joseph Caruso’s Select Equity Group and Chase Coleman’s Tiger Global Management LLC. In terms of the portfolio weights assigned to each position Stepstone Group allocated the biggest weight to Duck Creek Technologies, Inc. (NASDAQ:DCT), around 6.52% of its 13F portfolio. KCL Capital is also relatively very bullish on the stock, earmarking 0.85 percent of its 13F equity portfolio to DCT.

Because Duck Creek Technologies, Inc. (NASDAQ:DCT) has faced bearish sentiment from hedge fund managers, logic holds that there exists a select few funds who sold off their full holdings in the first quarter. At the top of the heap, Anand Parekh’s Alyeska Investment Group said goodbye to the biggest stake of the “upper crust” of funds followed by Insider Monkey, valued at about $3 million in stock, and Greg Eisner’s Engineers Gate Manager was right behind this move, as the fund said goodbye to about $2.3 million worth. These moves are important to note, as total hedge fund interest was cut by 3 funds in the first quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Duck Creek Technologies, Inc. (NASDAQ:DCT) but similarly valued. We will take a look at First Industrial Realty Trust, Inc. (NYSE:FR), Louisiana-Pacific Corporation (NYSE:LPX), Colfax Corporation (NYSE:CFX), New York Community Bancorp, Inc. (NYSE:NYCB), MSA Safety Incorporated (NYSE:MSA), Medpace Holdings, Inc. (NASDAQ:MEDP), and Integra Lifesciences Holdings Corp (NASDAQ:IART). This group of stocks’ market values are similar to DCT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FR | 20 | 416925 | -6 |

| LPX | 30 | 771996 | -11 |

| CFX | 49 | 1009256 | 13 |

| NYCB | 25 | 329163 | 0 |

| MSA | 17 | 29716 | 4 |

| MEDP | 21 | 265560 | -4 |

| IART | 13 | 96207 | 0 |

| Average | 25 | 416975 | -0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $417 million. That figure was $311 million in DCT’s case. Colfax Corporation (NYSE:CFX) is the most popular stock in this table. On the other hand Integra Lifesciences Holdings Corp (NASDAQ:IART) is the least popular one with only 13 bullish hedge fund positions. Duck Creek Technologies, Inc. (NASDAQ:DCT) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for DCT is 36.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and surpassed the market again by 7.7 percentage points. Unfortunately DCT wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); DCT investors were disappointed as the stock returned -4.5% since the end of March (through 7/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Duck Creek Technologies Inc. (NASDAQ:DCT)

Follow Duck Creek Technologies Inc. (NASDAQ:DCT)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Best Solar Energy Stocks To Invest In

- 15 Largest Industrial Companies In The US

- Top 10 Cloud Computing Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.