Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Deckers Outdoor Corp (NYSE:DECK).

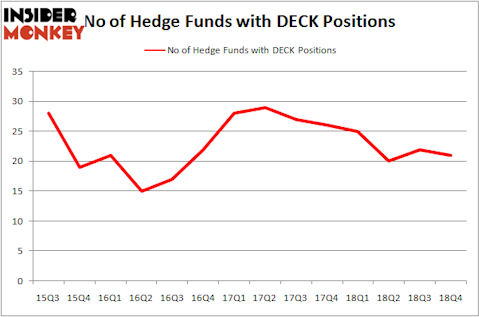

Is Deckers Outdoor Corp (NYSE:DECK) a safe investment today? Money managers are taking a pessimistic view. The number of long hedge fund bets went down by 1 recently. Our calculations also showed that DECK isn’t among the 30 most popular stocks among hedge funds. DECK was in 21 hedge funds’ portfolios at the end of December. There were 22 hedge funds in our database with DECK holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the new hedge fund action regarding Deckers Outdoor Corp (NYSE:DECK).

Hedge fund activity in Deckers Outdoor Corp (NYSE:DECK)

At the end of the fourth quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DECK over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Deckers Outdoor Corp (NYSE:DECK) was held by AQR Capital Management, which reported holding $193.4 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $75.3 million position. Other investors bullish on the company included HBK Investments, Point72 Asset Management, and Two Sigma Advisors.

Because Deckers Outdoor Corp (NYSE:DECK) has witnessed a decline in interest from the smart money, logic holds that there exists a select few hedge funds who were dropping their entire stakes last quarter. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the biggest investment of all the hedgies monitored by Insider Monkey, totaling an estimated $25.6 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dropped its stock, about $3.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 1 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Deckers Outdoor Corp (NYSE:DECK) but similarly valued. These stocks are Synovus Financial Corp. (NYSE:SNV), Healthequity Inc (NASDAQ:HQY), CarGurus, Inc. (NASDAQ:CARG), and Sterling Bancorp (NYSE:STL). This group of stocks’ market valuations resemble DECK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNV | 32 | 688626 | 0 |

| HQY | 18 | 65346 | 3 |

| CARG | 19 | 630327 | 2 |

| STL | 18 | 445056 | -3 |

| Average | 21.75 | 457339 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $457 million. That figure was $398 million in DECK’s case. Synovus Financial Corp. (NYSE:SNV) is the most popular stock in this table. On the other hand Healthequity Inc (NASDAQ:HQY) is the least popular one with only 18 bullish hedge fund positions. Deckers Outdoor Corp (NYSE:DECK) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on DECK, though not to the same extent, as the stock returned 17.1% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.