How do we determine whether CymaBay Therapeutics Inc (NASDAQ:CBAY) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

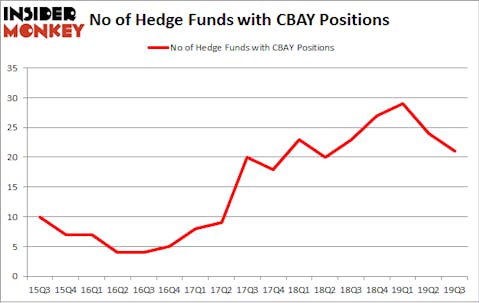

Is CymaBay Therapeutics Inc (NASDAQ:CBAY) a marvelous investment today? Hedge funds are becoming less confident. The number of bullish hedge fund positions were cut by 3 in recent months. Our calculations also showed that CBAY isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of indicators investors can use to grade stocks. A duo of the less known indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top fund managers can outclass the market by a healthy margin (see the details here).

Israel Englander of Millennium Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the fresh hedge fund action encompassing CymaBay Therapeutics Inc (NASDAQ:CBAY).

Hedge fund activity in CymaBay Therapeutics Inc (NASDAQ:CBAY)

Heading into the fourth quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the second quarter of 2019. On the other hand, there were a total of 23 hedge funds with a bullish position in CBAY a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

More specifically, Baker Bros. Advisors was the largest shareholder of CymaBay Therapeutics Inc (NASDAQ:CBAY), with a stake worth $29.2 million reported as of the end of September. Trailing Baker Bros. Advisors was Millennium Management, which amassed a stake valued at $19.1 million. Point72 Asset Management, Redmile Group, and venBio Select Advisor were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Foresite Capital allocated the biggest weight to CymaBay Therapeutics Inc (NASDAQ:CBAY), around 2.95% of its 13F portfolio. Vivo Capital is also relatively very bullish on the stock, earmarking 1.26 percent of its 13F equity portfolio to CBAY.

Judging by the fact that CymaBay Therapeutics Inc (NASDAQ:CBAY) has witnessed declining sentiment from the smart money, logic holds that there exists a select few hedge funds who sold off their entire stakes by the end of the third quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, worth an estimated $1.4 million in stock, and Kamran Moghtaderi’s Eversept Partners was right behind this move, as the fund cut about $0.6 million worth. These transactions are important to note, as total hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as CymaBay Therapeutics Inc (NASDAQ:CBAY) but similarly valued. These stocks are Adverum Biotechnologies, Inc. (NASDAQ:ADVM), Teekay Tankers Ltd. (NYSE:TNK), Clearwater Paper Corporation (NYSE:CLW), and MagnaChip Semiconductor Corporation (NYSE:MX). This group of stocks’ market values resemble CBAY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADVM | 11 | 83191 | -4 |

| TNK | 18 | 30256 | 6 |

| CLW | 7 | 20731 | -1 |

| MX | 19 | 138277 | -2 |

| Average | 13.75 | 68114 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $156 million in CBAY’s case. MagnaChip Semiconductor Corporation (NYSE:MX) is the most popular stock in this table. On the other hand Clearwater Paper Corporation (NYSE:CLW) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks CymaBay Therapeutics Inc (NASDAQ:CBAY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CBAY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CBAY were disappointed as the stock returned -65.6% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.