We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Criteo SA (NASDAQ:CRTO).

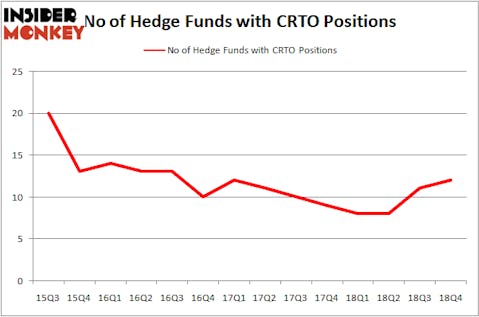

Criteo SA (NASDAQ:CRTO) has experienced an increase in enthusiasm from smart money lately. CRTO was in 12 hedge funds’ portfolios at the end of December. There were 11 hedge funds in our database with CRTO positions at the end of the previous quarter. Our calculations also showed that CRTO isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the key hedge fund action regarding Criteo SA (NASDAQ:CRTO).

What have hedge funds been doing with Criteo SA (NASDAQ:CRTO)?

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in CRTO a year ago. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, International Value Advisers was the largest shareholder of Criteo SA (NASDAQ:CRTO), with a stake worth $85.1 million reported as of the end of December. Trailing International Value Advisers was Citadel Investment Group, which amassed a stake valued at $32.3 million. Greenvale Capital, North Run Capital, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers were leading the bulls’ herd. Greenvale Capital, managed by Bruce Emery, assembled the most outsized position in Criteo SA (NASDAQ:CRTO). Greenvale Capital had $18.2 million invested in the company at the end of the quarter. Thomas Ellis and Todd Hammer’s North Run Capital also initiated a $5.5 million position during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, David Costen Haley’s HBK Investments, and Kerr Neilson’s Platinum Asset Management.

Let’s now review hedge fund activity in other stocks similar to Criteo SA (NASDAQ:CRTO). These stocks are Hope Bancorp, Inc. (NASDAQ:HOPE), SJW Group (NYSE:SJW), Verra Mobility Corporation (NASDAQ:VRRM), and Flagstar Bancorp Inc (NYSE:FBC). This group of stocks’ market valuations are closest to CRTO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HOPE | 17 | 59065 | 3 |

| SJW | 20 | 175605 | 9 |

| VRRM | 13 | 132441 | -4 |

| FBC | 12 | 106657 | -3 |

| Average | 15.5 | 118442 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $118 million. That figure was $155 million in CRTO’s case. SJW Group (NYSE:SJW) is the most popular stock in this table. On the other hand Flagstar Bancorp Inc (NYSE:FBC) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Criteo SA (NASDAQ:CRTO) is even less popular than FBC. Hedge funds dodged a bullet by taking a bearish stance towards CRTO. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CRTO wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); CRTO investors were disappointed as the stock returned -2.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.