We can judge whether Covenant Transportation Group, Inc. (NASDAQ:CVTI) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

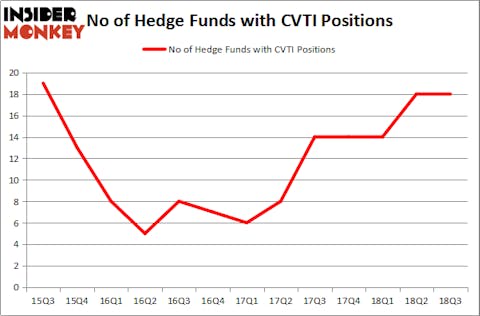

Covenant Transportation Group, Inc. (NASDAQ:CVTI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of September. At the end of this article we will also compare CVTI to other stocks including Sutherland Asset Management Corporation (NYSE:SLD), Verastem Inc (NASDAQ:VSTM), and Arrow Financial Corporation (NASDAQ:AROW) to get a better sense of its popularity.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the key hedge fund action surrounding Covenant Transportation Group, Inc. (NASDAQ:CVTI).

What does the smart money think about Covenant Transportation Group, Inc. (NASDAQ:CVTI)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, representing no change from the second quarter of 2018. On the other hand, there were a total of 14 hedge funds with a bullish position in CVTI at the beginning of this year. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Covenant Transportation Group, Inc. (NASDAQ:CVTI), which was worth $7.6 million at the end of the third quarter. On the second spot was Sandler Capital Management which amassed $6.9 million worth of shares. Moreover, Two Sigma Advisors, 12th Street Asset Management, and ACK Asset Management were also bullish on Covenant Transportation Group, Inc. (NASDAQ:CVTI), allocating a large percentage of their portfolios to this stock.

Because Covenant Transportation Group, Inc. (NASDAQ:CVTI) has faced bearish sentiment from hedge fund managers, we can see that there were a few hedgies who were dropping their entire stakes heading into Q3. It’s worth mentioning that George McCabe’s Portolan Capital Management said goodbye to the biggest position of the “upper crust” of funds tracked by Insider Monkey, totaling about $9.3 million in call options, and Andrew Sandler’s Sandler Capital Management was right behind this move, as the fund dumped about $3.9 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Covenant Transportation Group, Inc. (NASDAQ:CVTI) but similarly valued. We will take a look at Sutherland Asset Management Corporation (NYSE:SLD), Verastem Inc (NASDAQ:VSTM), Arrow Financial Corporation (NASDAQ:AROW), and Cardlytics, Inc. (NASDAQ:CDLX). This group of stocks’ market valuations are closest to CVTI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLD | 4 | 39817 | -1 |

| VSTM | 12 | 62059 | 4 |

| AROW | 4 | 12453 | 1 |

| CDLX | 7 | 31035 | -1 |

| Average | 6.75 | 36341 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $39 million in CVTI’s case. Verastem Inc (NASDAQ:VSTM) is the most popular stock in this table. On the other hand Sutherland Asset Management Corporation (NYSE:SLD) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Covenant Transportation Group, Inc. (NASDAQ:CVTI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.