After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Cott Corporation (NYSE:COT).

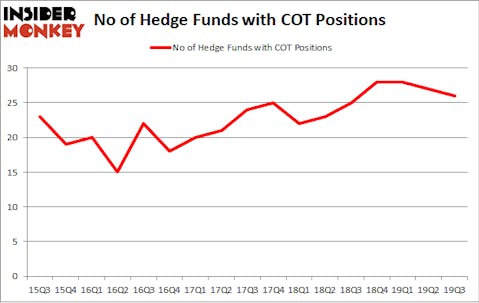

Is Cott Corporation (NYSE:COT) a great investment right now? The smart money is taking a bearish view. The number of long hedge fund positions went down by 1 in recent months. Our calculations also showed that COT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). COT was in 26 hedge funds’ portfolios at the end of the third quarter of 2019. There were 27 hedge funds in our database with COT holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a large number of indicators shareholders put to use to grade their stock investments. Two of the less known indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best fund managers can outpace the market by a significant margin (see the details here).

Israel Englander of Millennium Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the latest hedge fund action surrounding Cott Corporation (NYSE:COT).

What does smart money think about Cott Corporation (NYSE:COT)?

Heading into the fourth quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the previous quarter. By comparison, 25 hedge funds held shares or bullish call options in COT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Nitorum Capital held the most valuable stake in Cott Corporation (NYSE:COT), which was worth $131.4 million at the end of the third quarter. On the second spot was Levin Easterly Partners which amassed $124.8 million worth of shares. P2 Capital Partners, Interval Partners, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Nitorum Capital allocated the biggest weight to Cott Corporation (NYSE:COT), around 7.65% of its portfolio. P2 Capital Partners is also relatively very bullish on the stock, dishing out 5.37 percent of its 13F equity portfolio to COT.

Due to the fact that Cott Corporation (NYSE:COT) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of money managers that elected to cut their positions entirely by the end of the third quarter. It’s worth mentioning that Joseph Mathias’s Concourse Capital Management dumped the biggest stake of the 750 funds tracked by Insider Monkey, comprising close to $1.5 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also cut its stock, about $0.7 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cott Corporation (NYSE:COT) but similarly valued. We will take a look at Usa Compression Partners LP (NYSE:USAC), Veoneer, Inc. (NYSE:VNE), U.S. Physical Therapy, Inc. (NYSE:USPH), and Calavo Growers, Inc. (NASDAQ:CVGW). All of these stocks’ market caps are closest to COT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USAC | 4 | 5116 | 1 |

| VNE | 10 | 149807 | -2 |

| USPH | 12 | 64630 | 1 |

| CVGW | 17 | 108346 | 2 |

| Average | 10.75 | 81975 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $588 million in COT’s case. Calavo Growers, Inc. (NASDAQ:CVGW) is the most popular stock in this table. On the other hand Usa Compression Partners LP (NYSE:USAC) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Cott Corporation (NYSE:COT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on COT, though not to the same extent, as the stock returned 7.7% during the fourth quarter (through the end of November) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.