The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing more than 750 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th, 2019. In this article we are going to take a look at smart money sentiment towards Corporacion America Airports SA (NYSE:CAAP).

Corporacion America Airports SA (NYSE:CAAP) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of September. At the end of this article we will also compare CAAP to other stocks including Cerus Corporation (NASDAQ:CERS), Tutor Perini Corp (NYSE:TPC), and RadNet Inc. (NASDAQ:RDNT) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are seen as underperforming, outdated investment tools of the past. While there are over 8000 funds in operation at the moment, We look at the elite of this club, around 750 funds. These investment experts manage most of all hedge funds’ total capital, and by watching their best equity investments, Insider Monkey has figured out several investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

James Dondero of Highland Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s review the latest hedge fund action regarding Corporacion America Airports SA (NYSE:CAAP).

How are hedge funds trading Corporacion America Airports SA (NYSE:CAAP)?

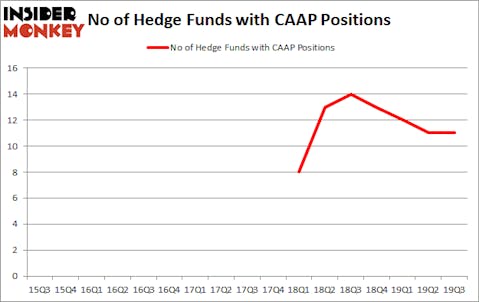

Heading into the fourth quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CAAP over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Noah Levy and Eugene Dozortsev’s Newtyn Management has the number one position in Corporacion America Airports SA (NYSE:CAAP), worth close to $9.3 million, comprising 0.9% of its total 13F portfolio. Sitting at the No. 2 spot is Highland Capital Management, managed by James Dondero, which holds a $5.9 million position; 0.4% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions include Thomas Bancroft’s Makaira Partners, Michael R. Weisberg’s Crestwood Capital Management and Bruce J. Richards and Louis Hanover’s Marathon Asset Management. In terms of the portfolio weights assigned to each position Crestwood Capital Management allocated the biggest weight to Corporacion America Airports SA (NYSE:CAAP), around 1.38% of its 13F portfolio. Newtyn Management is also relatively very bullish on the stock, earmarking 0.87 percent of its 13F equity portfolio to CAAP.

Judging by the fact that Corporacion America Airports SA (NYSE:CAAP) has experienced declining sentiment from the entirety of the hedge funds we track, we can see that there were a few money managers that slashed their positions entirely heading into Q4. At the top of the heap, Scott Bessent’s Key Square Capital Management dropped the biggest investment of the 750 funds tracked by Insider Monkey, comprising about $11.6 million in stock. Hugh Sloane’s fund, Sloane Robinson Investment Management, also dropped its stock, about $3.8 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Corporacion America Airports SA (NYSE:CAAP) but similarly valued. We will take a look at Cerus Corporation (NASDAQ:CERS), Tutor Perini Corp (NYSE:TPC), RadNet Inc. (NASDAQ:RDNT), and Uxin Limited (NASDAQ:UXIN). This group of stocks’ market values are closest to CAAP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CERS | 8 | 84245 | -5 |

| TPC | 9 | 6194 | 3 |

| RDNT | 14 | 72325 | 3 |

| UXIN | 4 | 23965 | 1 |

| Average | 8.75 | 46682 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $27 million in CAAP’s case. RadNet Inc. (NASDAQ:RDNT) is the most popular stock in this table. On the other hand Uxin Limited (NASDAQ:UXIN) is the least popular one with only 4 bullish hedge fund positions. Corporacion America Airports SA (NYSE:CAAP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CAAP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CAAP were disappointed as the stock returned -4.4% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.