At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not Cornerstone OnDemand, Inc. (NASDAQ:CSOD) makes for a good investment right now.

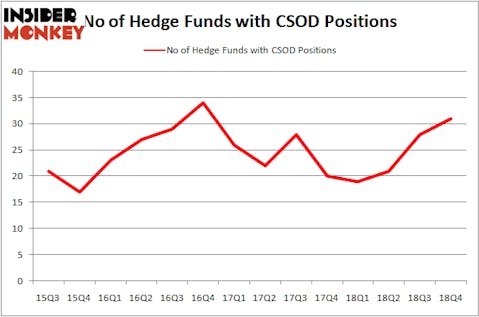

Cornerstone OnDemand, Inc. (NASDAQ:CSOD) was in 31 hedge funds’ portfolios at the end of the fourth quarter of 2018. CSOD shareholders have witnessed an increase in enthusiasm from smart money in recent months. There were 28 hedge funds in our database with CSOD holdings at the end of the previous quarter. Our calculations also showed that CSOD isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a multitude of signals stock market investors have at their disposal to grade their stock investments. Two of the best signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can outpace the market by a solid amount (see the details here).

We’re going to take a gander at the new hedge fund action regarding Cornerstone OnDemand, Inc. (NASDAQ:CSOD).

How have hedgies been trading Cornerstone OnDemand, Inc. (NASDAQ:CSOD)?

Heading into the first quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CSOD over the last 14 quarters. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Praesidium Investment Management Company held the most valuable stake in Cornerstone OnDemand, Inc. (NASDAQ:CSOD), which was worth $173.6 million at the end of the third quarter. On the second spot was RGM Capital which amassed $99.8 million worth of shares. Moreover, Tensile Capital, Citadel Investment Group, and Black-and-White Capital were also bullish on Cornerstone OnDemand, Inc. (NASDAQ:CSOD), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Thames Capital Management, managed by Jay Genzer, established the biggest position in Cornerstone OnDemand, Inc. (NASDAQ:CSOD). Thames Capital Management had $4.7 million invested in the company at the end of the quarter. Josh Goldberg’s G2 Investment Partners Management also made a $2.9 million investment in the stock during the quarter. The following funds were also among the new CSOD investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Cliff Asness’s AQR Capital Management, and Phil Frohlich’s Prescott Group Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cornerstone OnDemand, Inc. (NASDAQ:CSOD) but similarly valued. These stocks are TriNet Group Inc (NYSE:TNET), Mednax Inc. (NYSE:MD), Hancock Whitney Corporation (NASDAQ:HWC), and LHC Group, Inc. (NASDAQ:LHCG). This group of stocks’ market values resemble CSOD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TNET | 17 | 233555 | -4 |

| MD | 25 | 480820 | 0 |

| HWC | 15 | 111721 | -9 |

| LHCG | 27 | 111944 | 2 |

| Average | 21 | 234510 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $235 million. That figure was $601 million in CSOD’s case. LHC Group, Inc. (NASDAQ:LHCG) is the most popular stock in this table. On the other hand Hancock Whitney Corporation (NASDAQ:HWC) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Cornerstone OnDemand, Inc. (NASDAQ:CSOD) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CSOD wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CSOD were disappointed as the stock returned 4.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.