At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Is Columbia Financial, Inc. (NASDAQ:CLBK) a bargain? Money managers are taking a pessimistic view. The number of bullish hedge fund bets were trimmed by 1 lately. Our calculations also showed that CLBK isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several gauges stock market investors use to analyze their stock investments. A duo of the less known gauges are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite fund managers can outperform the S&P 500 by a healthy margin (see the details here).

Let’s go over the latest hedge fund action encompassing Columbia Financial, Inc. (NASDAQ:CLBK).

What have hedge funds been doing with Columbia Financial, Inc. (NASDAQ:CLBK)?

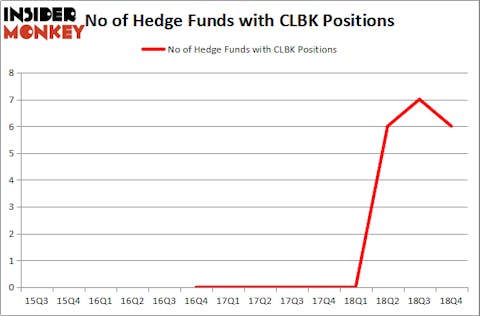

At the end of the fourth quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CLBK over the last 14 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Ancora Advisors held the most valuable stake in Columbia Financial, Inc. (NASDAQ:CLBK), which was worth $9.1 million at the end of the fourth quarter. On the second spot was MFP Investors which amassed $7.6 million worth of shares. Moreover, Seidman Investment Partnership, Citadel Investment Group, and Dorset Management were also bullish on Columbia Financial, Inc. (NASDAQ:CLBK), allocating a large percentage of their portfolios to this stock.

Due to the fact that Columbia Financial, Inc. (NASDAQ:CLBK) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few money managers that slashed their full holdings last quarter. At the top of the heap, Louis Bacon’s Moore Global Investments cut the biggest stake of all the hedgies monitored by Insider Monkey, comprising close to $1.7 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also said goodbye to its stock, about $0.3 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Columbia Financial, Inc. (NASDAQ:CLBK). These stocks are Pacira Pharmaceuticals Inc (NASDAQ:PCRX), Mack Cali Realty Corp (NYSE:CLI), Opko Health Inc. (NASDAQ:OPK), and Kosmos Energy Ltd (NYSE:KOS). This group of stocks’ market caps match CLBK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PCRX | 25 | 540796 | 0 |

| CLI | 9 | 115323 | -2 |

| OPK | 15 | 5892 | 1 |

| KOS | 14 | 107311 | -4 |

| Average | 15.75 | 192331 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $192 million. That figure was $25 million in CLBK’s case. Pacira Pharmaceuticals Inc (NASDAQ:PCRX) is the most popular stock in this table. On the other hand Mack Cali Realty Corp (NYSE:CLI) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Columbia Financial, Inc. (NASDAQ:CLBK) is even less popular than CLI. Hedge funds dodged a bullet by taking a bearish stance towards CLBK. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CLBK wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); CLBK investors were disappointed as the stock returned -0.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.