Is Clearwater Paper Corp (NYSE:CLW) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

Is Clearwater Paper Corp (NYSE:CLW) a great investment today? The best stock pickers are reducing their bets on the stock. The number of long hedge fund positions were cut by 1 recently. Our calculations also showed that CLW isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s take a look at the key hedge fund action encompassing Clearwater Paper Corp (NYSE:CLW).

Hedge fund activity in Clearwater Paper Corp (NYSE:CLW)

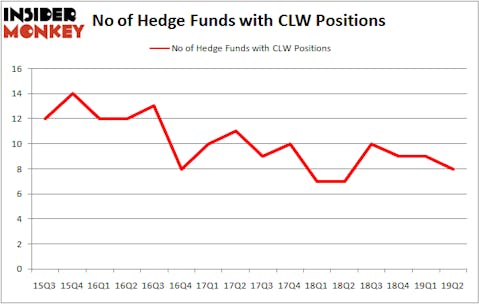

At Q2’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in CLW over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Sabrepoint Capital, managed by George Baxter, holds the largest position in Clearwater Paper Corp (NYSE:CLW). Sabrepoint Capital has a $12.6 million position in the stock, comprising 5.6% of its 13F portfolio. The second most bullish fund manager is Sabrepoint Capital, led by George Baxter, holding a $12.1 million call position; the fund has 5.4% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish encompass Israel Englander’s Millennium Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Ken Griffin’s Citadel Investment Group.

Since Clearwater Paper Corp (NYSE:CLW) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of money managers that decided to sell off their positions entirely in the second quarter. It’s worth mentioning that John Overdeck and David Siegel’s Two Sigma Advisors cut the largest position of the “upper crust” of funds watched by Insider Monkey, comprising an estimated $0.7 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund sold off about $0.7 million worth. These transactions are interesting, as total hedge fund interest dropped by 1 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to Clearwater Paper Corp (NYSE:CLW). These stocks are Kaleido BioSciences, Inc. (NASDAQ:KLDO), Greenlight Capital Re, Ltd. (NASDAQ:GLRE), Source Capital, Inc. (NYSE:SOR), and Cumulus Media Inc (NASDAQ:CMLS). All of these stocks’ market caps are similar to CLW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KLDO | 5 | 12913 | -1 |

| GLRE | 8 | 3855 | 5 |

| SOR | 2 | 7237 | 0 |

| CMLS | 9 | 117968 | -4 |

| Average | 6 | 35493 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $19 million in CLW’s case. Cumulus Media Inc (NASDAQ:CMLS) is the most popular stock in this table. On the other hand Source Capital, Inc. (NYSE:SOR) is the least popular one with only 2 bullish hedge fund positions. Clearwater Paper Corp (NYSE:CLW) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CLW as the stock returned 14.2% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.