Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 13.5% in the fourth quarter. Seven out of 11 industry groups in the S&P 500 Index were down more than 20% from their 52-week highs at the trough of the stock market crash. The average return of a randomly picked stock in the index was even worse. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 15 most popular S&P 500 stocks among hedge funds not only recouped their Q4 losses but also outperformed the index by more than 3 percentage points. In this article, we will take a look at what hedge funds think about Chemical Financial Corporation (NASDAQ:CHFC).

Chemical Financial Corporation (NASDAQ:CHFC) shareholders have witnessed an increase in hedge fund sentiment lately. Our calculations also showed that chfc isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the latest hedge fund action surrounding Chemical Financial Corporation (NASDAQ:CHFC).

Hedge fund activity in Chemical Financial Corporation (NASDAQ:CHFC)

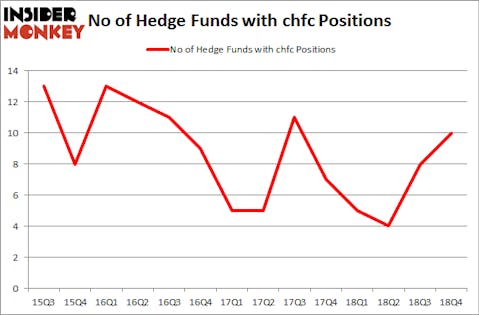

At the end of the fourth quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CHFC over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Chemical Financial Corporation (NASDAQ:CHFC), which was worth $8.7 million at the end of the third quarter. On the second spot was Millennium Management which amassed $8.3 million worth of shares. Moreover, Castine Capital Management, Marshall Wace LLP, and Renaissance Technologies were also bullish on Chemical Financial Corporation (NASDAQ:CHFC), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, initiated the most valuable position in Chemical Financial Corporation (NASDAQ:CHFC). Renaissance Technologies had $4.3 million invested in the company at the end of the quarter. Emanuel J. Friedman’s EJF Capital also initiated a $0.6 million position during the quarter. The other funds with new positions in the stock are David Costen Haley’s HBK Investments and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Chemical Financial Corporation (NASDAQ:CHFC) but similarly valued. These stocks are Silgan Holdings Inc. (NASDAQ:SLGN), BancorpSouth Bank (NYSE:BXS), Vishay Intertechnology, Inc. (NYSE:VSH), and Smartsheet Inc. (NYSE:SMAR). All of these stocks’ market caps resemble CHFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLGN | 14 | 108007 | 2 |

| BXS | 9 | 54741 | 2 |

| VSH | 19 | 333325 | -3 |

| SMAR | 17 | 186129 | 6 |

| Average | 14.75 | 170551 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $171 million. That figure was $36 million in CHFC’s case. Vishay Intertechnology, Inc. (NYSE:VSH) is the most popular stock in this table. On the other hand BancorpSouth Bank (NYSE:BXS) is the least popular one with only 9 bullish hedge fund positions. Chemical Financial Corporation (NASDAQ:CHFC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CHFC, though not to the same extent, as the stock returned 17.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.