Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Cheetah Mobile Inc (NYSE:CMCM).

Is Cheetah Mobile Inc (NYSE:CMCM) ready to rally soon? Money managers are selling. The number of bullish hedge fund bets retreated by 3 lately. Our calculations also showed that cmcm isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the fresh hedge fund action regarding Cheetah Mobile Inc (NYSE:CMCM).

How have hedgies been trading Cheetah Mobile Inc (NYSE:CMCM)?

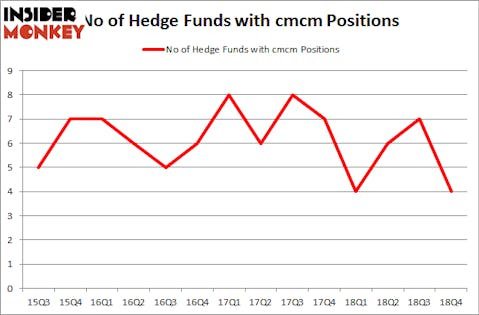

At Q4’s end, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -43% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CMCM over the last 14 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Israel Englander’s Millennium Management has the largest position in Cheetah Mobile Inc (NYSE:CMCM), worth close to $2.7 million, corresponding to less than 0.1%% of its total 13F portfolio. Coming in second is Jim Simons of Renaissance Technologies, with a $2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other peers that hold long positions consist of Ken Griffin’s Citadel Investment Group, Daniel S. Och’s OZ Management and Matthew Hulsizer’s PEAK6 Capital Management.

Due to the fact that Cheetah Mobile Inc (NYSE:CMCM) has faced falling interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few funds who sold off their positions entirely last quarter. Intriguingly, D. E. Shaw’s D E Shaw said goodbye to the biggest investment of all the hedgies tracked by Insider Monkey, comprising close to $1.4 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund said goodbye to about $0.7 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Cheetah Mobile Inc (NYSE:CMCM). We will take a look at Apollo Investment Corp. (NASDAQ:AINV), Middlesex Water Company (NASDAQ:MSEX), Boingo Wireless Inc (NASDAQ:WIFI), and Carbonite Inc (NASDAQ:CARB). This group of stocks’ market valuations are similar to CMCM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AINV | 15 | 29542 | 7 |

| MSEX | 11 | 48580 | 2 |

| WIFI | 18 | 125999 | 1 |

| CARB | 16 | 108510 | -1 |

| Average | 15 | 78158 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $5 million in CMCM’s case. Boingo Wireless Inc (NASDAQ:WIFI) is the most popular stock in this table. On the other hand Middlesex Water Company (NASDAQ:MSEX) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Cheetah Mobile Inc (NYSE:CMCM) is even less popular than MSEX. Hedge funds dodged a bullet by taking a bearish stance towards CMCM. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CMCM wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); CMCM investors were disappointed as the stock returned 3.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.