Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Cheetah Mobile Inc (NYSE:CMCM).

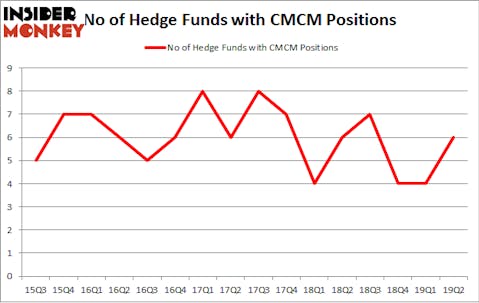

Is Cheetah Mobile Inc (NYSE:CMCM) the right pick for your portfolio? Hedge funds are in a bullish mood. The number of bullish hedge fund bets increased by 2 in recent months. Our calculations also showed that CMCM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the recent hedge fund action regarding Cheetah Mobile Inc (NYSE:CMCM).

Hedge fund activity in Cheetah Mobile Inc (NYSE:CMCM)

At Q2’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the first quarter of 2019. By comparison, 6 hedge funds held shares or bullish call options in CMCM a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Cheetah Mobile Inc (NYSE:CMCM), which was worth $3.3 million at the end of the second quarter. On the second spot was Millennium Management which amassed $1.7 million worth of shares. Moreover, D E Shaw, Citadel Investment Group, and Coatue Management were also bullish on Cheetah Mobile Inc (NYSE:CMCM), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Coatue Management, managed by Philippe Laffont, established the largest position in Cheetah Mobile Inc (NYSE:CMCM). Coatue Management had $0 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also made a $0 million investment in the stock during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cheetah Mobile Inc (NYSE:CMCM) but similarly valued. These stocks are Marine Products Corporation (NYSE:MPX), A10 Networks Inc (NYSE:ATEN), Vista Outdoor Inc (NYSE:VSTO), and The First Bancshares, Inc. (NASDAQ:FBMS). This group of stocks’ market valuations are closest to CMCM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MPX | 5 | 18141 | -1 |

| ATEN | 15 | 102500 | -3 |

| VSTO | 16 | 72142 | -1 |

| FBMS | 7 | 28083 | -1 |

| Average | 10.75 | 55217 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $55 million. That figure was $6 million in CMCM’s case. Vista Outdoor Inc (NYSE:VSTO) is the most popular stock in this table. On the other hand Marine Products Corporation (NYSE:MPX) is the least popular one with only 5 bullish hedge fund positions. Cheetah Mobile Inc (NYSE:CMCM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CMCM as the stock returned 14.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.