Is Central Pacific Financial Corp. (NYSE:CPF) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

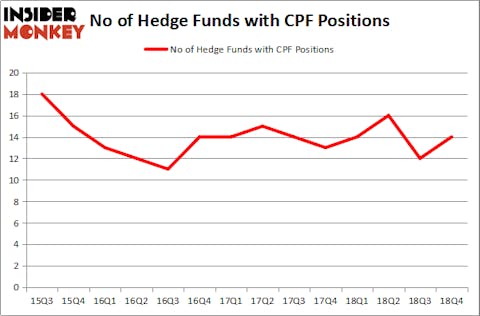

Central Pacific Financial Corp. (NYSE:CPF) investors should pay attention to an increase in hedge fund interest of late. CPF was in 14 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 12 hedge funds in our database with CPF positions at the end of the previous quarter. Our calculations also showed that CPF isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are several tools stock market investors use to assess stocks. A couple of the less known tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best investment managers can outperform the broader indices by a very impressive amount (see the details here).

We’re going to go over the recent hedge fund action surrounding Central Pacific Financial Corp. (NYSE:CPF).

Hedge fund activity in Central Pacific Financial Corp. (NYSE:CPF)

Heading into the first quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the second quarter of 2018. On the other hand, there were a total of 14 hedge funds with a bullish position in CPF a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Central Pacific Financial Corp. (NYSE:CPF), which was worth $16.1 million at the end of the fourth quarter. On the second spot was GLG Partners which amassed $11.4 million worth of shares. Moreover, Prospector Partners, Millennium Management, and D E Shaw were also bullish on Central Pacific Financial Corp. (NYSE:CPF), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, some big names have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Central Pacific Financial Corp. (NYSE:CPF). Arrowstreet Capital had $0.9 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also initiated a $0 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Central Pacific Financial Corp. (NYSE:CPF). These stocks are Fidelity Southern Corporation (NASDAQ:LION), Cellectis SA (NASDAQ:CLLS), Maxar Technologies Ltd. (NYSE:MAXR), and Chico’s FAS, Inc. (NYSE:CHS). All of these stocks’ market caps are similar to CPF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LION | 9 | 57537 | 0 |

| CLLS | 8 | 33807 | -5 |

| MAXR | 8 | 5833 | 1 |

| CHS | 14 | 66024 | -4 |

| Average | 9.75 | 40800 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $65 million in CPF’s case. Chico’s FAS, Inc. (NYSE:CHS) is the most popular stock in this table. On the other hand Cellectis SA (NASDAQ:CLLS) is the least popular one with only 8 bullish hedge fund positions. Central Pacific Financial Corp. (NYSE:CPF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on CPF, though not to the same extent, as the stock returned 19.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.