The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards CDK Global Inc (NASDAQ:CDK).

CDK Global Inc (NASDAQ:CDK) investors should pay attention to a decrease in support from the world’s most elite money managers of late. Our calculations also showed that CDK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are many signals market participants employ to evaluate stocks. A couple of the most useful signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the elite money managers can outclass the broader indices by a very impressive amount (see the details here).

Jeffrey Gates of Gates Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to go over the new hedge fund action surrounding CDK Global Inc (NASDAQ:CDK).

What have hedge funds been doing with CDK Global Inc (NASDAQ:CDK)?

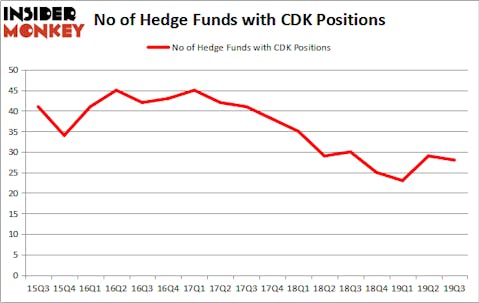

Heading into the fourth quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CDK over the last 17 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Anthony Bozza’s Lakewood Capital Management has the most valuable position in CDK Global Inc (NASDAQ:CDK), worth close to $93.3 million, amounting to 3.2% of its total 13F portfolio. On Lakewood Capital Management’s heels is Gates Capital Management, led by Jeffrey Gates, holding a $71.4 million position; 3.1% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish comprise David E. Shaw’s D E Shaw, Cliff Asness’s AQR Capital Management and Charles de Vaulx’s International Value Advisers. In terms of the portfolio weights assigned to each position Lakewood Capital Management allocated the biggest weight to CDK Global Inc (NASDAQ:CDK), around 3.18% of its portfolio. Gates Capital Management is also relatively very bullish on the stock, earmarking 3.09 percent of its 13F equity portfolio to CDK.

Seeing as CDK Global Inc (NASDAQ:CDK) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of funds who were dropping their positions entirely heading into Q4. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital said goodbye to the biggest investment of all the hedgies monitored by Insider Monkey, worth about $35.1 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also sold off its stock, about $3.6 million worth. These moves are interesting, as total hedge fund interest was cut by 1 funds heading into Q4.

Let’s go over hedge fund activity in other stocks similar to CDK Global Inc (NASDAQ:CDK). We will take a look at Enel Chile S.A. (NYSE:ENIC), Wix.Com Ltd (NASDAQ:WIX), Versum Materials, Inc. (NYSE:VSM), and Gardner Denver Holdings, Inc. (NYSE:GDI). This group of stocks’ market valuations resemble CDK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENIC | 8 | 26016 | 2 |

| WIX | 31 | 986992 | 5 |

| VSM | 31 | 1007124 | -5 |

| GDI | 15 | 379484 | -9 |

| Average | 21.25 | 599904 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $600 million. That figure was $473 million in CDK’s case. Wix.Com Ltd (NASDAQ:WIX) is the most popular stock in this table. On the other hand Enel Chile S.A. (NYSE:ENIC) is the least popular one with only 8 bullish hedge fund positions. CDK Global Inc (NASDAQ:CDK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on CDK as the stock returned 11.4% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.