Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the nearly unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

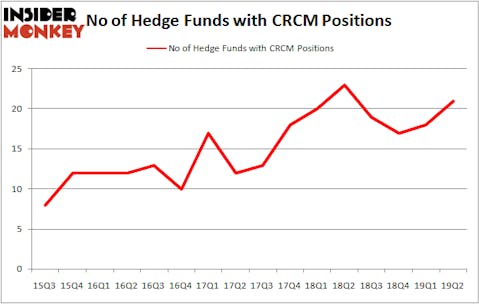

Is Care.com Inc (NYSE:CRCM) going to take off soon? Prominent investors are in a bullish mood. The number of long hedge fund positions moved up by 3 recently. Our calculations also showed that CRCM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s view the recent hedge fund action encompassing Care.com Inc (NYSE:CRCM).

What does smart money think about Care.com Inc (NYSE:CRCM)?

At Q2’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CRCM over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Tenzing Global Investors held the most valuable stake in Care.com Inc (NYSE:CRCM), which was worth $26.9 million at the end of the second quarter. On the second spot was Renaissance Technologies which amassed $26.2 million worth of shares. Moreover, Portolan Capital Management, Cloverdale Capital Management, and Two Sigma Advisors were also bullish on Care.com Inc (NYSE:CRCM), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have been driving this bullishness. Cloverdale Capital Management, managed by C. Jonathan Gattman, created the largest position in Care.com Inc (NYSE:CRCM). Cloverdale Capital Management had $10.4 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $0.6 million position during the quarter. The other funds with new positions in the stock are Benjamin A. Smith’s Laurion Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Care.com Inc (NYSE:CRCM) but similarly valued. We will take a look at Calix Inc (NYSE:CALX), Miller Industries, Inc. (NYSE:MLR), Digi International Inc. (NASDAQ:DGII), and Guaranty Bancshares, Inc. (NASDAQ:GNTY). This group of stocks’ market caps are similar to CRCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CALX | 14 | 93596 | -3 |

| MLR | 8 | 51586 | 0 |

| DGII | 13 | 47047 | -2 |

| GNTY | 3 | 3672 | -1 |

| Average | 9.5 | 48975 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $114 million in CRCM’s case. Calix Inc (NYSE:CALX) is the most popular stock in this table. On the other hand Guaranty Bancshares, Inc. (NASDAQ:GNTY) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Care.com Inc (NYSE:CRCM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CRCM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CRCM were disappointed as the stock returned -4.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.