There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Cameco Corporation (USA) (NYSE:CCJ) .

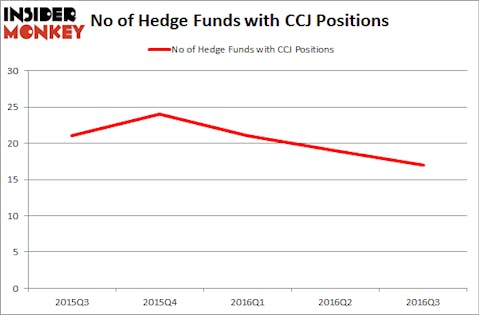

Cameco Corporation (USA) (NYSE:CCJ) investors should pay attention to a decrease in enthusiasm from smart money in recent months. Among the investors tracked by us, the stock was in 17 hedge funds’ portfolios at the end of the third quarter of 2016, compared to 19 funds at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Transocean LTD (NYSE:RIG), AmeriGas Partners, L.P. (NYSE:APU), and Banco Macro SA (ADR) (NYSE:BMA) to gather more data points.

Follow Cameco Corp (NYSE:CCJ)

Follow Cameco Corp (NYSE:CCJ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Syda Productions/Shutterstock.com

With all of this in mind, let’s take a look at the recent action regarding Cameco Corporation (USA) (NYSE:CCJ).

What does the smart money think about Cameco Corporation (USA) (NYSE:CCJ)?

At the end of September, 17 funds tracked by Insider Monkey were long this stock, down by 11% from one quarter earlier. By comparison, 24 hedge funds held shares or bullish call options in CCJ heading into this year. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Kopernik Global Investors, led by David Iben, holds the largest position in Cameco Corporation (USA) (NYSE:CCJ). Kopernik Global Investors has a $66.7 million position in the stock, comprising 14.3% of its 13F portfolio. The second most bullish fund manager is Adage Capital Management, led by Phill Gross and Robert Atchinson, holding a $52.3 million position; 0.1% of its 13F portfolio is allocated to the company. Some other peers that are bullish encompass Cliff Asness’s AQR Capital Management, Jim Simons’ Renaissance Technologies and Lei Zhang’s Hillhouse Capital Management. We should note that Kopernik Global Investors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Cameco Corporation (USA) (NYSE:CCJ) has sustained falling interest from the smart money, we can see that there were a few hedge funds who were dropping their positions entirely by the end of the third quarter. Interestingly, Robert Vollero and Gentry T. Beach’s Vollero Beach Capital Partners cashed in the biggest investment of the 700 funds watched by Insider Monkey, valued at close to $1.7 million in stock, and David Costen Haley’s HBK Investments was right behind this move, as the fund dropped about $1.3 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Cameco Corporation (USA) (NYSE:CCJ) but similarly valued. These stocks are Transocean LTD (NYSE:RIG), AmeriGas Partners, L.P. (NYSE:APU), Banco Macro SA (ADR) (NYSE:BMA), and MSC Industrial Direct Co Inc (NYSE:MSM). This group of stocks’ market caps are similar to CCJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RIG | 35 | 457059 | 3 |

| APU | 8 | 5691 | 3 |

| BMA | 18 | 148895 | 2 |

| MSM | 21 | 555966 | -5 |

As you can see these stocks had an average of 21 funds with bullish positions and the average amount invested in these stocks was $292 million. That figure was $200 million in CCJ’s case. Transocean LTD (NYSE:RIG) is the most popular stock in this table. On the other hand AmeriGas Partners, L.P. (NYSE:APU) is the least popular one with only eight investors having reported long positions. Cameco Corporation (USA) (NYSE:CCJ) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Transocean LTD (NYSE:RIG) might be a better candidate to consider taking a long position in.