Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of California Resources Corp (NYSE:CRC) based on that data.

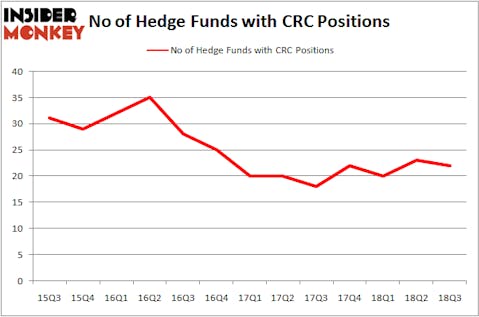

California Resources Corp (NYSE:CRC) was in 22 hedge funds’ portfolios at the end of September. CRC has experienced a small decrease in activity from the world’s largest hedge funds of late, as there were 23 hedge funds in our database with CRC positions at the end of the previous quarter. The number of shareholders with long positions in the company was far from enough for it to be considered as one of the 30 most popular stocks among hedge funds in Q3 of 2018. In spite of this, we would still like to analyze the stock further and check out how popular the company is when compared to similarly valued businesses.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

While researching about California Resources Corp (NYSE:CRC) furthermore, we stumbled upon JDP Capital Management’s Partnership & Performance Update, in which the company was analyzed. We bring you that part of the report.

“California Resources was a busted spin-out of Occidental Petroleum Corp (OXY0 days before the 2014 oil crash and the only US E&P to remain cash flow positive throughout the downturn. CRC is the largest oil and gas producer in CA with critical infrastructure to the world’s 5th largest economy. Due to regulatory constraints CRC competes with South America and Canadian tar sands and not mid-west shale of Gulf of Mexico (Brent vs. WTI).

Why it’s worth more

- California regulatory environment creates irreplaceable moat

- Current $35/share implies ~4xEV/EBITDA (consensus)

- Near term refinancing of debt will boost cash flow by ~30% and unlock growth

- Series of major financial and operational improvements not reflected in outdated debt rating and crisis-era high interest rates

- Debt declining from 8.1x(YE ’16) to ~2.5x YE’19

- Positive Free Cash Flow generation relative to US peers masks optically high debt balance

- $100 per share (equity value) in proven reserves at $75/Brent oil

- $150-$200 per share based on non-distressed peer multiple of of 8x-10x EBITDA”

Now, let’s view the fresh hedge fund action encompassing California Resources Corp (NYSE:CRC).

How are hedge funds trading California Resources Corp (NYSE:CRC)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CRC over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in California Resources Corp (NYSE:CRC) was held by D E Shaw, which reported holding $97.2 million worth of stock at the end of September. It was followed by Cyrus Capital Partners with a $70.5 million position. Other investors bullish on the company included Crescent Park Management, Masters Capital Management, and Elm Ridge Capital.

Judging by the fact that California Resources Corp (NYSE:CRC) has witnessed falling interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of fund managers who sold off their positions entirely last quarter. At the top of the heap, Vince Maddi and Shawn Brennan’s SIR Capital Management dropped the largest stake of the “upper crust” of funds watched by Insider Monkey, totaling close to $18.4 million in stock, and Todd J. Kantor’s Encompass Capital Advisors was right behind this move, as the fund dropped about $14.7 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 1 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to California Resources Corp (NYSE:CRC). We will take a look at Cal-Maine Foods Inc (NASDAQ:CALM), Yext, Inc. (NYSE:YEXT), El Paso Electric Company (NYSE:EE), and Main Street Capital Corporation (NYSE:MAIN). All of these stocks’ market caps are similar to CRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CALM | 21 | 190329 | 1 |

| YEXT | 16 | 203971 | 2 |

| EE | 15 | 308083 | 4 |

| MAIN | 8 | 8622 | 1 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $178 million. That figure was $414 million in CRC’s case. Cal-Maine Foods Inc (NASDAQ:CALM) is the most popular stock in this table. On the other hand Main Street Capital Corporation (NYSE:MAIN) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks California Resources Corp (NYSE:CRC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.