Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Calavo Growers, Inc. (NASDAQ:CVGW) to find out whether it was one of their high conviction long-term ideas.

Is Calavo Growers, Inc. (NASDAQ:CVGW) a splendid investment now? Prominent investors are in a pessimistic mood. The number of bullish hedge fund bets dropped by 2 recently. Our calculations also showed that CVGW isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action surrounding Calavo Growers, Inc. (NASDAQ:CVGW).

What have hedge funds been doing with Calavo Growers, Inc. (NASDAQ:CVGW)?

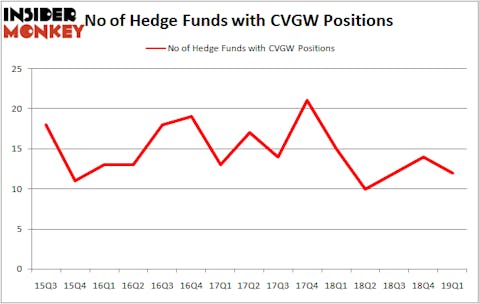

At the end of the first quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CVGW over the last 15 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Calavo Growers, Inc. (NASDAQ:CVGW) was held by Cardinal Capital, which reported holding $23.9 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $12.4 million position. Other investors bullish on the company included Millennium Management, Citadel Investment Group, and Harvest Capital Strategies.

Judging by the fact that Calavo Growers, Inc. (NASDAQ:CVGW) has experienced declining sentiment from the smart money, we can see that there lies a certain “tier” of money managers that decided to sell off their positions entirely in the third quarter. Intriguingly, Richard Driehaus’s Driehaus Capital dumped the biggest stake of the 700 funds watched by Insider Monkey, valued at about $5.2 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund said goodbye to about $1 million worth. These moves are interesting, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Calavo Growers, Inc. (NASDAQ:CVGW). We will take a look at Advanced Drainage Systems, Inc. (NYSE:WMS), Heartland Financial USA Inc (NASDAQ:HTLF), Ship Finance International Limited (NYSE:SFL), and Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). This group of stocks’ market valuations are similar to CVGW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WMS | 17 | 273479 | 0 |

| HTLF | 8 | 24084 | 1 |

| SFL | 6 | 35658 | -6 |

| KLIC | 17 | 199631 | -2 |

| Average | 12 | 133213 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $47 million in CVGW’s case. Advanced Drainage Systems, Inc. (NYSE:WMS) is the most popular stock in this table. On the other hand Ship Finance International Limited (NYSE:SFL) is the least popular one with only 6 bullish hedge fund positions. Calavo Growers, Inc. (NASDAQ:CVGW) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on CVGW as the stock returned 15.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.