We can judge whether Bunge Ltd (NYSE:BG) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

Coming off a Q2 in which it lost hedge fund support for the first time in two years, ownership of Bunge stabilized in Q3, being flat during the quarter. That left it a long ways from making our list of the 30 Most Popular Stocks Among Hedge Funds, though it ranked highly among the 20 Dividend Stocks That Billionaires Are Piling On, coming in at 12th. Bunge raised its dividend by 8.7% in May, the 17th-straight year it’s increased its annual payout to shareholders.

According to most shareholders, hedge funds are viewed as slow, old financial tools of yesteryear. While there are more than 8,000 funds in operation at the moment, we look at the masters of this club, around 700 funds. These investment experts preside over the majority of all hedge funds’ total asset base, and by monitoring their finest picks, Insider Monkey has identified many investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Hedge fund activity in Bunge Ltd (NYSE:BG)

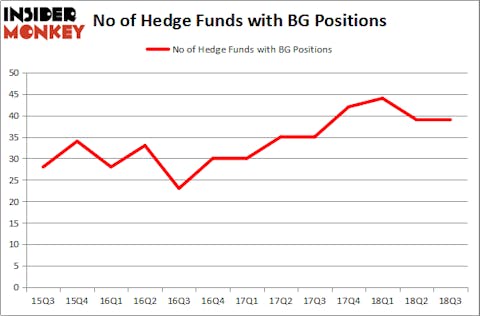

At Q3’s end, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BG over the last 13 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Bunge Ltd (NYSE:BG) was held by Point72 Asset Management, which reported holding $185.8 million worth of stock as of the end of September. It was followed by Carlson Capital with a $154.6 million position. Other investors bullish on the company included Citadel Investment Group and Adage Capital Management.

Since Bunge Ltd (NYSE:BG) has experienced falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of funds that elected to cut their positions entirely in the third quarter. At the top of the heap, James Dinan’s York Capital Management said goodbye to the largest position of the 700 funds watched by Insider Monkey, worth about $66 million in stock, and Deepak Gulati’s Argentiere Capital was right behind this move, as the fund sold off about $5.2 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Bunge Ltd (NYSE:BG) but similarly valued. These stocks are Perrigo Company plc (NASDAQ:PRGO), EXACT Sciences Corporation (NASDAQ:EXAS), STERIS plc (NYSE:STE), and Qorvo Inc (NASDAQ:QRVO). This group of stocks’ market caps are similar to BG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRGO | 21 | 1045562 | -4 |

| EXAS | 33 | 625480 | 2 |

| STE | 21 | 268624 | 0 |

| QRVO | 28 | 1567995 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $877 million. That figure was $1.30 billion in BG’s case. EXACT Sciences Corporation (NASDAQ:EXAS) is the most popular stock in this table. On the other hand Perrigo Company plc (NASDAQ:PRGO) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Bunge Ltd (NYSE:BG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.