Is Bryn Mawr Bank Corp. (NASDAQ:BMTC) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is Bryn Mawr Bank Corp. (NASDAQ:BMTC) a bargain? Investors who are in the know are becoming hopeful. The number of long hedge fund bets advanced by 2 in recent months. Our calculations also showed that BMTC isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are viewed as slow, old financial vehicles of yesteryear. While there are more than 8000 funds with their doors open today, Our experts hone in on the upper echelon of this club, approximately 750 funds. These money managers preside over the lion’s share of the hedge fund industry’s total capital, and by tailing their top equity investments, Insider Monkey has formulated many investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the latest hedge fund action surrounding Bryn Mawr Bank Corp. (NASDAQ:BMTC).

What does smart money think about Bryn Mawr Bank Corp. (NASDAQ:BMTC)?

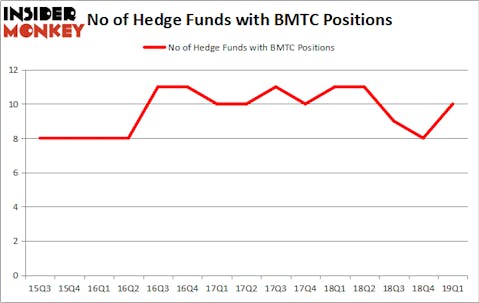

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards BMTC over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Bryn Mawr Bank Corp. (NASDAQ:BMTC) was held by Renaissance Technologies, which reported holding $28.6 million worth of stock at the end of March. It was followed by Polaris Capital Management with a $2.6 million position. Other investors bullish on the company included AlphaOne Capital Partners, Royce & Associates, and D E Shaw.

As industrywide interest jumped, key money managers have been driving this bullishness. Millennium Management, managed by Israel Englander, initiated the largest position in Bryn Mawr Bank Corp. (NASDAQ:BMTC). Millennium Management had $0.5 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also initiated a $0 million position during the quarter.

Let’s check out hedge fund activity in other stocks similar to Bryn Mawr Bank Corp. (NASDAQ:BMTC). These stocks are Allegiance Bancshares, Inc. (NASDAQ:ABTX), Oaktree Specialty Lending Corporation (NASDAQ:OCSL), Central Securities Corporation (NYSEAMEX:CET), and Community Trust Bancorp, Inc. (NASDAQ:CTBI). This group of stocks’ market values are similar to BMTC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ABTX | 7 | 25758 | 1 |

| OCSL | 19 | 68979 | 7 |

| CET | 3 | 10638 | 1 |

| CTBI | 8 | 20202 | 1 |

| Average | 9.25 | 31394 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $36 million in BMTC’s case. Oaktree Specialty Lending Corporation (NASDAQ:OCSL) is the most popular stock in this table. On the other hand Central Securities Corporation (NYSEAMEX:CET) is the least popular one with only 3 bullish hedge fund positions. Bryn Mawr Bank Corp. (NASDAQ:BMTC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BMTC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BMTC were disappointed as the stock returned 3.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.