A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended December 31, so let’s proceed with the discussion of the hedge fund sentiment on Bryn Mawr Bank Corp. (NASDAQ:BMTC).

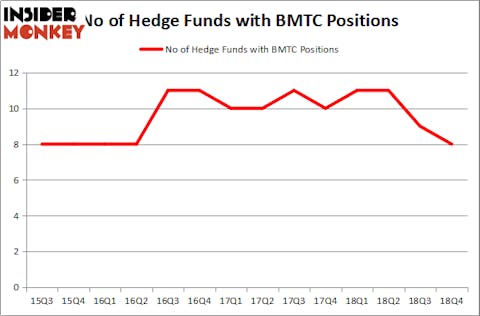

Is Bryn Mawr Bank Corp. (NASDAQ:BMTC) going to take off soon? Money managers are becoming less confident. The number of long hedge fund positions were cut by 1 recently. Our calculations also showed that BMTC isn’t among the 30 most popular stocks among hedge funds. BMTC was in 8 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with BMTC positions at the end of the previous quarter.

To the average investor there are a large number of gauges stock market investors can use to appraise their holdings. Some of the best gauges are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can outpace the S&P 500 by a solid amount (see the details here).

We’re going to review the fresh hedge fund action encompassing Bryn Mawr Bank Corp. (NASDAQ:BMTC).

How have hedgies been trading Bryn Mawr Bank Corp. (NASDAQ:BMTC)?

At Q4’s end, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from one quarter earlier. By comparison, 11 hedge funds held shares or bullish call options in BMTC a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, managed by Jim Simons, holds the largest position in Bryn Mawr Bank Corp. (NASDAQ:BMTC). Renaissance Technologies has a $27.9 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Renaissance Technologies’s heels is AlphaOne Capital Partners, managed by Paul Hondros, which holds a $3.2 million position; 1.3% of its 13F portfolio is allocated to the company. Some other peers that are bullish comprise Bernard Horn’s Polaris Capital Management, D. E. Shaw’s D E Shaw and Chuck Royce’s Royce & Associates.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Two Sigma Advisors. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified BMTC as a viable investment and initiated a position in the stock.

Let’s now take a look at hedge fund activity in other stocks similar to Bryn Mawr Bank Corp. (NASDAQ:BMTC). These stocks are Tidewater Inc. (NYSE:TDW), Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB), FutureFuel Corp. (NYSE:FF), and UroGen Pharma Ltd. (NASDAQ:URGN). This group of stocks’ market values match BMTC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TDW | 14 | 176770 | 3 |

| YMAB | 6 | 51844 | -5 |

| FF | 14 | 57050 | 3 |

| URGN | 12 | 142984 | -1 |

| Average | 11.5 | 107162 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $38 million in BMTC’s case. Tidewater Inc. (NYSE:TDW) is the most popular stock in this table. On the other hand Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB) is the least popular one with only 6 bullish hedge fund positions. Bryn Mawr Bank Corp. (NASDAQ:BMTC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BMTC wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); BMTC investors were disappointed as the stock returned 3.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.