The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards BioScrip Inc. (NASDAQ:BIOS), and what that likely means for the prospects of the company and its stock.

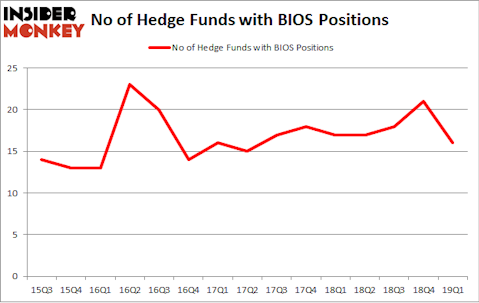

BioScrip Inc. (NASDAQ:BIOS) was in 16 hedge funds’ portfolios at the end of March. BIOS shareholders have witnessed a decrease in enthusiasm from smart money in recent months. There were 21 hedge funds in our database with BIOS positions at the end of the previous quarter. Our calculations also showed that bios isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a gander at the fresh hedge fund action encompassing BioScrip Inc. (NASDAQ:BIOS).

How have hedgies been trading BioScrip Inc. (NASDAQ:BIOS)?

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -24% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BIOS over the last 15 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Venor Capital Management was the largest shareholder of BioScrip Inc. (NASDAQ:BIOS), with a stake worth $23.9 million reported as of the end of March. Trailing Venor Capital Management was D E Shaw, which amassed a stake valued at $6.6 million. Diamond Hill Capital, Alta Fundamental Advisers, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that BioScrip Inc. (NASDAQ:BIOS) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few money managers that elected to cut their positions entirely heading into Q3. At the top of the heap, Steve Cohen’s Point72 Asset Management sold off the biggest investment of the 700 funds followed by Insider Monkey, comprising about $3.1 million in stock, and James E. Flynn’s Deerfield Management was right behind this move, as the fund cut about $2.7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 5 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to BioScrip Inc. (NASDAQ:BIOS). We will take a look at Neptune Wellness Solutions Inc. (NASDAQ:NEPT), CapStar Financial Holdings, Inc. (NASDAQ:CSTR), Superior Group of Companies, Inc. (NASDAQ:SGC), and Owens & Minor, Inc. (NYSE:OMI). This group of stocks’ market values are closest to BIOS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEPT | 8 | 31034 | -1 |

| CSTR | 6 | 18011 | 1 |

| SGC | 5 | 5309 | 1 |

| OMI | 15 | 17670 | 0 |

| Average | 8.5 | 18006 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $55 million in BIOS’s case. Owens & Minor, Inc. (NYSE:OMI) is the most popular stock in this table. On the other hand Superior Group of Companies, Inc. (NASDAQ:SGC) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks BioScrip Inc. (NASDAQ:BIOS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on BIOS as the stock returned 16% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.