At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

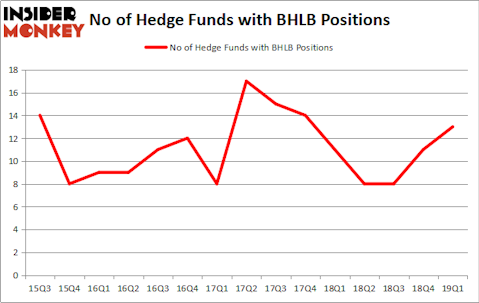

Berkshire Hills Bancorp, Inc. (NYSE:BHLB) was in 13 hedge funds’ portfolios at the end of March. BHLB has experienced an increase in activity from the world’s largest hedge funds recently. There were 11 hedge funds in our database with BHLB holdings at the end of the previous quarter. Our calculations also showed that BHLB isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are dozens of tools stock market investors put to use to evaluate publicly traded companies. Some of the most under-the-radar tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top fund managers can outpace the S&P 500 by a solid margin (see the details here).

Let’s take a glance at the new hedge fund action encompassing Berkshire Hills Bancorp, Inc. (NYSE:BHLB).

How are hedge funds trading Berkshire Hills Bancorp, Inc. (NYSE:BHLB)?

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the fourth quarter of 2018. On the other hand, there were a total of 11 hedge funds with a bullish position in BHLB a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Berkshire Hills Bancorp, Inc. (NYSE:BHLB) was held by EJF Capital, which reported holding $14.2 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $13.5 million position. Other investors bullish on the company included Millennium Management, Prospector Partners, and Marshall Wace LLP.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. EJF Capital, managed by Emanuel J. Friedman, established the largest position in Berkshire Hills Bancorp, Inc. (NYSE:BHLB). EJF Capital had $14.2 million invested in the company at the end of the quarter. John D. Gillespie’s Prospector Partners also initiated a $4.7 million position during the quarter. The following funds were also among the new BHLB investors: Ravi Chopra’s Azora Capital, Paul Tudor Jones’s Tudor Investment Corp, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Berkshire Hills Bancorp, Inc. (NYSE:BHLB) but similarly valued. These stocks are OceanFirst Financial Corp. (NASDAQ:OCFC), Camping World Holdings, Inc. (NYSE:CWH), The Marcus Corporation (NYSE:MCS), and US Ecology Inc. (NASDAQ:ECOL). All of these stocks’ market caps are closest to BHLB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OCFC | 13 | 60218 | 1 |

| CWH | 10 | 103692 | -1 |

| MCS | 16 | 97320 | 5 |

| ECOL | 9 | 14502 | -2 |

| Average | 12 | 68933 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $69 million. That figure was $51 million in BHLB’s case. The Marcus Corporation (NYSE:MCS) is the most popular stock in this table. On the other hand US Ecology Inc. (NASDAQ:ECOL) is the least popular one with only 9 bullish hedge fund positions. Berkshire Hills Bancorp, Inc. (NYSE:BHLB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on BHLB as the stock returned 13.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.